So, You Want to Start Crypto Trading?

The cryptocurrency world may seem intimidatingly complex and confusing, but beginner crypto trading definitely doesn’t have to be, because terms like “blockchain,” “DeFi,” and “NFTs,” not to mention the market’s rapid price fluctuations can be confusing and intimidating when you are first starting.

With the right education and methodical approach to trading, anyone should be able to participate in this emerging marketplace with confidence. Following are important actions and concepts to help with your entry into the world of digital assets.

1. Learn the Basics of Beginner Crypto Trading

Before you invest, take the time to understand the essentials. Beginner crypto trading is simply buying and selling digital currency (like Bitcoin, Ethereum, and altcoins) through cryptocurrency exchanges that trade in digital assets (similar to the stock trading of S&P stocks).

One thing to grasp early on is volatility. Cryptocurrency can and will fluctuate wildly, even on a day-to-day basis. A coin may go up 15% in the morning and then down 20% by the evening. Such volatility is commonplace in crypto and cannot be emphasized enough for staying calm and informed.

2. Pick a Reliable Exchange Platform

The most important factor in crypto trading for beginners, is deciding where you will trade. You have various platform options to choose from, and each platform subjectively, probably takes, fees, user experience and security protocols. For beginners, the most well-known platforms like Coinbase, Binance and Kraken are good choices. They are legit, user friendly, and sometimes have resources for learning.

Always confirm that the platform is regulated and follows Know Your Customer (KYC) protocols. These verified identity components assist in protecting both parties and the platform. Stay away from any lesser-known exchanges that have promising marketing and security protocols, but do not practice secure trading behaviors.

3. Choose the Right Wallet Setup

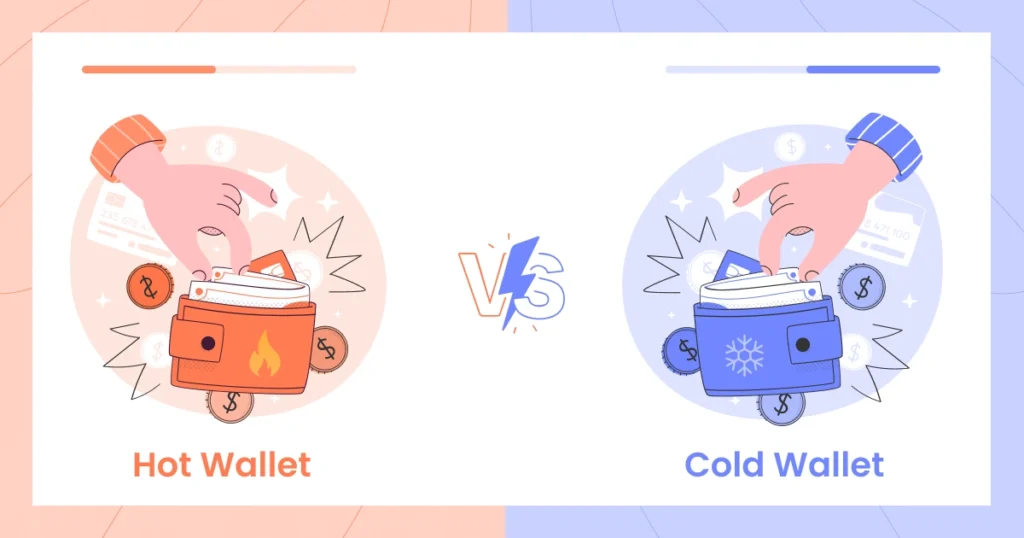

Once you have selected your exchange, you need to create your crypto wallet. This is the location where you will store your assets after purchasing them. Wallets are available in two varieties: hot wallets or cold wallets.

Hot wallets are internet connected and will allow you to trade assets conveniently for everyday trading. Most exchanges offer a wallet that is built-in to their exchange, which is ideal for beginning traders who are just starting with poorer amounts of money. However, these wallets are often hacked and are less secure.

Cold wallets are physical devices or offline software that will allow you to secure your assets in a more secure electronic wallet. If you are going to hold long-term or store a higher amount of crypto, this is likely the best option for you. A good way to think about a wallet is to use a hot wallet for convenience, and move your assets into a cold wallet as you accumulate more holdings.

4. Start Small and Build Experience

When you’re just beginning, resist the urge to invest heavily or chase trends. One of the most common beginner crypto trading mistakes is getting caught up in the hype of the latest meme coin or influencer tip. Instead, start with a small, manageable amount — enough to feel engaged, but not so much that a mistake will hurt financially.

Use this time to track market trends, understand what influences price changes, and follow reliable news sources. Hands-on experience is the best teacher. Even small trades will expose you to how order books, fees, and blockchain confirmations work.

5. Manage Your Risks and Stay Rational

Emotional trading is one of the fastest ways to lose money in crypto. Many beginners panic when prices drop or rush to buy when prices spike. Both moves are usually driven by emotion, not logic. One rule to live by: never invest more than you can afford to lose.

Create a simple strategy and stick to it. If you’re planning to hold your assets long-term, don’t check prices every hour. If you’re looking to make short-term trades, set stop-loss limits and take-profit targets. Either way, staying disciplined and calm will serve you far better than trying to outguess the market.

Final Thought: Beginner Crypto Trading is Achievable

Crypto can seem complex at first glance, but with the right foundation, beginner crypto trading is entirely accessible. By learning the basics, choosing secure tools, and starting slow, you’ll not only avoid common pitfalls but also build real confidence.

Remember: the market rewards patience, continuous learning, and thoughtful decision-making. Don’t worry about becoming an expert overnight. Focus on one step at a time, and you’ll gradually turn from a cautious beginner into a confident crypto participant.

Relevant news: here