Introduction: Why BI Forex Intervention Still Matters in 2025

Currency markets in 2025 are more sensitive than ever to global movements—be it from central bank policy shifts, geopolitical tensions, or commodity price shocks. For Indonesia, this means the rupiah remains vulnerable to external forces. That’s where BI forex intervention comes in. In this tutorial, we’ll walk through how Bank Indonesia intervenes in the forex market, what tools it uses, and why its actions are still vital in today’s economy.

Step 1: Understanding What BI Forex Intervention Actually Means

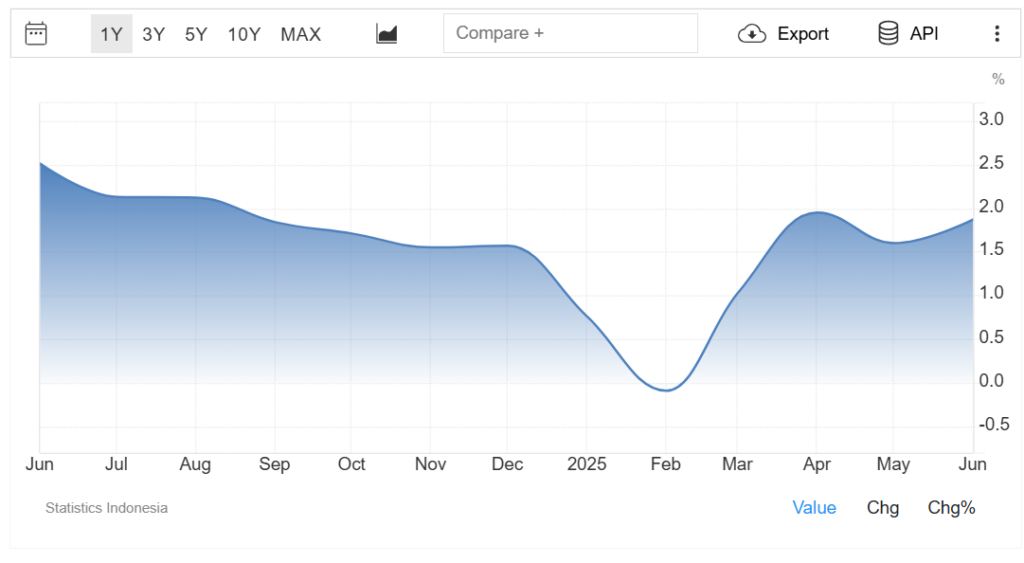

Source: TradingEconomics

At its core, BI forex intervention refers to the steps taken by Bank Indonesia to influence the exchange rate of the rupiah. This doesn’t mean fixing the currency at a specific value. Rather, it’s about minimizing sharp, speculative movements that can destabilize the economy. Especially in 2025, when investor sentiment can shift overnight, BI acts as a stabilizer—stepping into the market to manage liquidity and maintain orderly price action.

Step 2: Identifying When Bank Indonesia Intervenes

Source: Trading Economics

BI doesn’t operate on a set schedule. Instead, it watches the market carefully and steps in when needed—usually when the rupiah depreciates too rapidly or when capital outflows trigger disorderly conditions. In early 2025, for instance, following global financial tightening, the rupiah saw significant downward pressure. BI entered the forex market to cool volatility, using its tools to prevent panic and keep investor sentiment stable.

Step 3: Exploring the Tools Used in 2025

Bank Indonesia has multiple instruments at its disposal to manage the currency:

- Spot Market Operations: Buying or selling U.S. dollars directly to influence the supply of foreign exchange.

- Domestic Non-Deliverable Forwards (DNDFs): These forward contracts allow businesses to hedge future exchange rate exposure without affecting spot rates.

- Foreign Reserves: BI may use its U.S. dollar reserves to support the rupiah during stressed periods.

- Swap Facilities and Liquidity Lines: These help maintain market function when foreign currency demand surges.

In 2025, the use of DNDFs has become increasingly common, offering a more sophisticated way to address future expectations without spooking the present-day market.

Step 4: Understanding the Goal Behind the Intervention

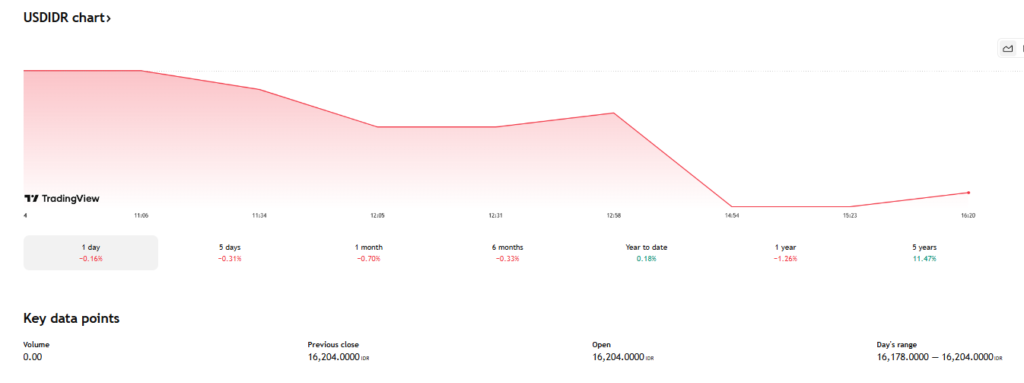

Source: TradingView

The main goal of BI forex intervention in 2025 isn’t to control the market but to preserve trust. By preventing wild currency swings, Bank Indonesia ensures inflation remains manageable, international trade isn’t disrupted, and local businesses have some predictability in their operations. This stabilizing role supports broader economic targets like employment, growth, and price stability.

Step 5: Measuring the Effectiveness of Intervention

Source: THE BUSINESS TIMES

How do we know if intervention works? Look at market behavior. When BI steps in, volatility usually tapers off, and the rupiah finds a more stable range. In 2025, BI has succeeded in keeping the currency from falling sharply even during global stress events. While it doesn’t eliminate depreciation altogether, the bank’s actions ensure that changes happen more gradually, giving businesses and policymakers time to adjust.

Step 6: Balancing Transparency with Market Stability

Source: BERNAMA

Bank Indonesia does not typically announce intervention actions as they happen. Full transparency, in this case, could do more harm than good—allowing speculators to game the system. However, BI does provide clear communication about its overall policy direction in press releases, monetary reports, and public statements. In 2025, this balance between signaling intent and protecting tactical flexibility remains critical to market confidence.

Step 7: The Real-World Impact for Indonesians

While the mechanics of forex intervention may seem abstract, the real-life consequences are very concrete. A weaker rupiah means higher prices for imported goods—fuel, technology, medicines, and more. Through timely intervention, BI helps limit these ripple effects. In 2025, this has meant fewer price shocks at the pump or supermarket shelves, and more predictable operating costs for businesses reliant on foreign inputs.

Conclusion: BI Forex Intervention as a Core Economic Shield in 2025

In an increasingly fast-moving financial world, BI forex intervention in 2025 remains one of Bank Indonesia’s key tools for economic resilience. Through a calculated blend of market activity, strategic communication, and institutional credibility, the central bank helps ensure that the rupiah reflects Indonesia’s real economy—not just global speculation. For anyone tracking currency, investment, or economic planning, understanding how BI navigates the forex market is essential knowledge for 2025 and beyond.