Digital Gold in Vietnam: A Real-World FAQ for New Investors

Buy golds through online? The idea of buying gold online without physically touching it still feels abstract for many in Vietnam. Gold has long been seen as a tangible asset — something you wear, store, or gift during Tết. But recently, there’s been growing curiosity around digital gold, especially among those who want flexibility and security without carrying around physical bars or jewelry.

So how exactly does this work? And more importantly, is it safe? In this FAQ-style article, we address the questions most commonly asked by first-time users trying to buy gold online or explore digital gold investment from within Vietnam.

What is digital gold, and how is it different from traditional gold?

Digital gold isn’t a new type of gold — it’s just a new way of owning it. When you buy gold online through a licensed platform in Vietnam, you’re purchasing physical gold stored in secure vaults. The difference is, instead of holding the metal in your hand, you own a digital certificate of that gold.

This method is especially popular for users who want flexibility. You can buy small quantities (even a fraction of a gram), track prices in real-time, and sell instantly without visiting a store. It’s the same gold, just handled differently.

Is digital gold actually safe to invest in?

Credit from vov.gov.vn

This is one of the most important concerns. In Vietnam, most platforms offering digital gold services operate under regulated partnerships with trusted local gold brands like SJC or DOJI. These companies back each digital purchase with a matching amount of physical gold stored securely.

However, safety still depends on the platform you use. It’s essential to choose platforms with clear terms of service, transparent pricing, and proper security measures (such as two-factor authentication and KYC verification). Just like you wouldn’t buy jewelry from a suspicious shop, don’t buy digital gold from apps you don’t trust.

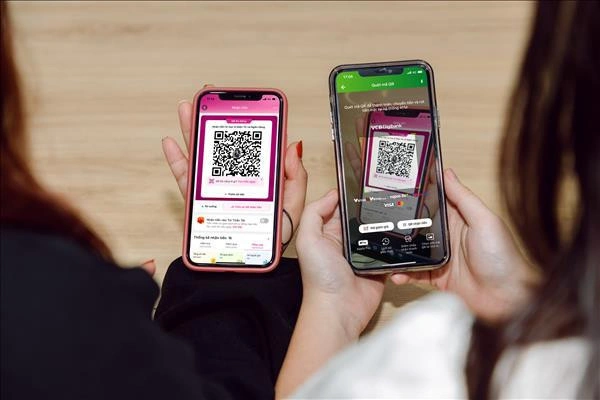

How do I actually buy gold online in Vietnam?

Credit from Timo Digital Bank by BVBank

Buying gold online can be as simple as ordering food through an app — but with more steps upfront. You’ll first need to register on a certified app or platform that offers gold investment options in Vietnam. These platforms often include fintech apps like MoMo, Timo, or VNDC, which partner with reputable gold suppliers.

Once you’re registered, you’ll complete identity verification (usually by submitting your ID and a selfie). Then you fund your account — often using a local bank or e-wallet. From there, you can buy gold instantly, track prices, and even sell or transfer it later.

Can I convert digital gold back into cash or physical gold?

Yes. Most digital gold platforms in Vietnam allow you to sell your holdings back into Vietnamese Dong, which is then transferred to your wallet or linked bank account. Some also offer redemption in physical gold — although this typically requires a minimum holding amount, and you might need to visit a partner store or pay a small fee for delivery.

This flexibility is part of what makes online gold trading in Vietnam so appealing. You get the benefits of liquidity and control, without giving up the option to “go physical” when needed.

What apps or platforms are best for Vietnamese users to Buy Gold Online?

Credit from Vietnam+ (VietnamPlus)

There isn’t a single “best” app — it depends on your needs. Some users prefer e-wallets like MoMo for convenience, while others lean toward platforms like VNDC for their broader crypto integration. The key is to look for platforms that are:

- Regulated in Vietnam

- Backed by licensed gold suppliers

- Transparent about their storage and fees

- Easy to use, even for beginners

It’s okay to explore and compare. Just don’t jump in without understanding the terms.

Do I need a lot of money to start investing in digital gold?

Not at all. In fact, one of the main appeals of digital gold Vietnam is that it’s accessible to anyone — not just traditional investors. Some platforms let you start with as little as 10,000–50,000 VND. This opens the door to students, young professionals, and low-risk investors looking to build wealth slowly.

Digital gold allows you to “scale in” over time, adding small amounts regularly instead of making one large, risky purchase.

Is digital gold affected by global gold prices?

Credit from Gold Price

Yes. When you buy gold online, your digital investment reflects the real-time market value of physical gold — often pegged to global benchmarks like the London Bullion Market. Prices may also vary slightly depending on the platform’s buy/sell spread or handling fees.

This means that your digital gold can go up or down in value based on global trends, inflation, demand, or even currency shifts. But for many, that’s part of the appeal — gold remains a hedge against volatility and inflation.

Can I give digital gold as a gift?

Interestingly, yes. Some apps now allow you to send digital gold to friends or family — a modern twist on the Vietnamese tradition of gifting vàng. It’s especially popular during holidays or as part of wedding contributions, offering a symbolic and practical gesture without the logistics of buying and delivering physical items.

Final Thoughts: Should You Buy Gold Online in Vietnam?

Whether you’re looking to diversify your savings, hedge against inflation, or simply explore new ways of investing, buying gold online offers a flexible, secure, and modern solution for Vietnamese users. The key is to start small, stay informed, and use platforms that treat your trust and investment with care.

As digital finance continues to grow in Vietnam, digital gold investment will likely become even more user-friendly — making now a smart time to learn the ropes.