Day trading risks are visible everywhere—you don’t have to look far to see the signs. At a coworking space in Da Nang, a university student toggles between TradingView charts and her Telegram group chat. In a coffee shop in District 1, someone casually discusses candle patterns between sips of iced coffee. Whether seasoned or just starting out, more Vietnamese are turning to day trading, even as financial experts warn that it’s not for the faint-hearted.

So, what’s driving this momentum—and why are people still trading despite the risks?

What Makes Day Trading So Appealing in Vietnam Right Now?

There’s something inherently magnetic about the promise of daily profits. With Vietnam’s youthful population, increased smartphone usage, and expanding access to online trading platforms, day trading is no longer reserved for institutional desks or finance professionals.

But more than just convenience, there’s a cultural and generational shift underway. Many young Vietnamese no longer see career stability as something tied to a single employer or a monthly salary. Instead, they seek financial autonomy—and for some, the stock market offers a potential route.

The ability to enter and exit positions within a day feels empowering. It offers a sense of control, a daily rhythm, and—perhaps most importantly—the chance to win, right now.

Day Trading Risks: Is Day Trading Safe?

The short answer is no—and few serious traders would argue otherwise.

Day trading risks come in many forms. There’s price volatility, unexpected news flow, emotional decision-making, and the ever-present possibility of losing money faster than expected. Without discipline, it becomes less a financial strategy and more a psychological rollercoaster.

In Vietnam, taxation adds an extra challenge. Every trade is taxed at 0.1% of the sale value, regardless of profit or loss. You can’t deduct losing trades from your gains, which means consistent profitability is even harder.

Still, that doesn’t deter new traders. In fact, for many, the challenge is part of the appeal.

How Is Day Trading Regulated in Vietnam?

Credit from lawnet.vn

Day trading is legal, but it comes with very specific rules.

According to Circular 120/2020/TT-BTC, a trader must sign a day-trading agreement with a licensed securities firm. Only certain stocks—usually those approved for margin trading—can be traded intraday. Trades must be matched within the same day: if you buy 1,000 shares, you must sell 1,000 shares of the same stock before the session ends.

You’re also only allowed one day trading account per firm, and securities companies can refuse orders if your account lacks sufficient cash or securities. It’s a tightly controlled environment.

Vietnam’s State Securities Commission (SSC) also has the right to suspend day trading if market conditions become unstable. It’s not a free-for-all—and understanding the rules is essential to avoid unintended penalties.

Day Trading Risks: Why Do Traders Still Take the Risk?

Risk alone isn’t enough to stop ambition. For many Vietnamese investors, especially those under 35, day trading feels like a test of skill. It’s not just about making money—it’s about learning patterns, understanding the market, and being part of a digital-savvy generation that doesn’t wait around for opportunity.

There’s also a social element. With forums, livestreams, and YouTube tutorials, trading isn’t a lonely practice—it’s a shared experience. And that visibility makes it feel more real and more achievable.

From a lifestyle standpoint, day trading also offers a level of flexibility. You can trade from anywhere, on your schedule. For freelancers or part-time workers, this financial freedom is hard to ignore.

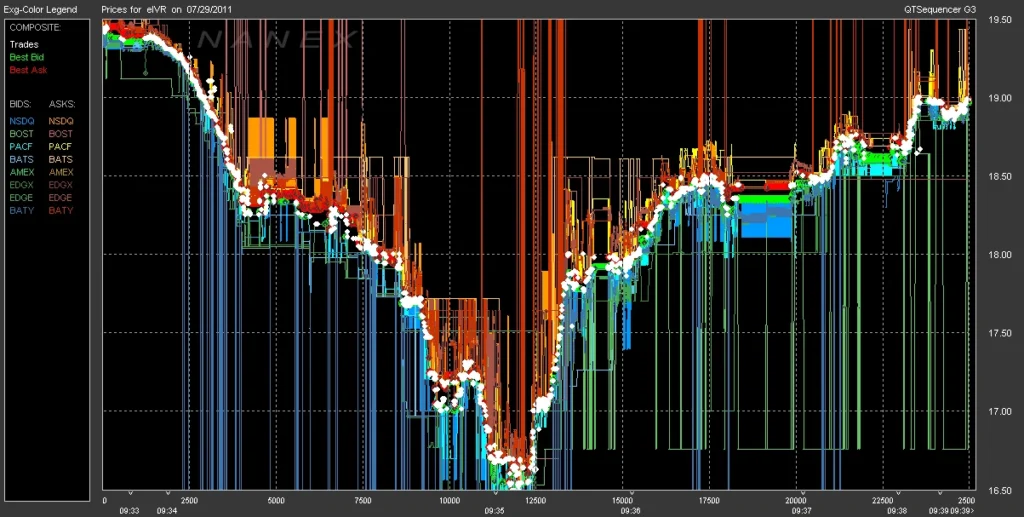

Isn’t This the Same as High-Frequency Trading?

Credit from QNT Tech

No, and that’s a common misconception. High-frequency trading (HFT) involves algorithms executing thousands of trades in milliseconds—something only institutions with powerful computing systems can do.

However, some retail traders in Vietnam mimic the style manually, relying on fast-paced scalping techniques and short-term patterns. The result is often more emotional and less precise, and without the infrastructure of HFT, it’s arguably even riskier.

Still, the desire to trade faster—and more often—remains deeply embedded in the day trader’s mindset.

Day Trading Risks: What Happens When Trades Go Wrong?

This is where day trading shows its darker side.

A few losing trades can erode not just your capital, but your confidence. The temptation to “make it back” by doubling down is common—and dangerous. Without strict risk controls, traders often spiral into reactive decisions.

In Vietnam, the inability to offset trading losses with tax deductions makes this even more painful. Every sale is taxed, no matter the outcome. Over time, even a relatively active trader can lose more to fees and taxes than they realize.

That’s why experienced day traders focus as much on preserving capital as they do on making gains.

Day Trading Risks: How Do Traders Actually Learn This?

Credit from DayTrading.com

Some start with demo accounts. Others learn through trial and error. Many are self-taught, pulling information from Telegram groups, Reddit threads, or TikTok tutorials. This mix of self-learning and community feedback gives rise to a fast-learning, risk-taking trading culture.

Still, the depth of understanding varies wildly. Without financial education in schools and limited official guidance, many new traders enter the market without clear strategies. This can make them vulnerable to market manipulation or misinformation.

That’s why local analysts often stress the importance of structured education and mentorship over fast, emotional decisions.

Day Trading Risks: Is There a Sustainable Way to Day Trade?

Yes—but it’s rare.

The most consistent day traders have a clear system. They use technical indicators, respect stop-loss limits, track performance metrics, and stay emotionally detached from the outcome. Many only risk 1–2% of their capital per trade. They treat trading like a job, not a game.

In Vietnam, trading through regulated platforms and sticking to approved instruments also helps avoid legal risks. This structured approach allows for growth and learning—without catastrophic losses along the way.

Why Does Day Trading Remain So Popular, Then?

It’s a mix of psychology, possibility, and timing.

Vietnam’s economy is on the rise. Wages are climbing, access to finance is improving, and global investing culture is just a tap away. Against this backdrop, day trading feels like a way to participate in the country’s momentum.

The dream of a self-directed life—financially and otherwise—is powerful. Even with all the warnings, some traders are willing to embrace the risks in exchange for the chance to do something different.

Final Reflection: The Paradox of Day Trading in Vietnam

Day trading is risky—unquestionably so. But for a generation navigating economic transitions, digital disruption, and shifting definitions of success, it also represents opportunity, challenge, and agency.

In Vietnam, that balance—between danger and possibility—is what keeps day trading both controversial and undeniably magnetic.

For those who pursue it, understanding the risks isn’t just a formality. It’s the very first investment.