In Vietnam, where crypto trading apps are as common as food delivery platforms, the ETH vs BTC conversation isn’t just for tech forums. From Gen Z traders to small business investors, the debate around ethereum growth versus Bitcoin’s resilience is now mainstream.

This FAQ-style breakdown explores the seven most frequently asked questions about these two crypto giants — from the streets of Ho Chi Minh City to blockchain Telegram groups across the country.

1. Why is ETH often more volatile than BTC in Vietnam’s crypto exchanges?

Ethereum’s price tends to reflect broader sentiment about Web3 trends — like NFTs, DeFi, and smart contract development. In contrast, Bitcoin often acts as a “reserve” crypto asset.

Because Vietnamese investors engage heavily in altcoin trading and staking (often built on Ethereum-based platforms), any movement in those ecosystems can drive stronger ETH price swings locally.

2. Is Ethereum growth still relevant after the 2022 Merge?

Absolutely. Post-Merge, Ethereum moved to proof-of-stake, which significantly reduced its energy usage. In Vietnam, this shift has drawn attention from younger traders and sustainability-minded investors alike.

Many view ethereum growth now as a multi-layered trend — not only price-based but also ecosystem-driven through staking, dApps, and Layer 2 integrations.

3. What use cases are Vietnamese investors exploring on Ethereum that Bitcoin doesn’t support?

ETH is more than a currency — it’s infrastructure. Vietnamese developers are using Ethereum to build:

- NFT marketplaces

- DeFi protocols

- Blockchain games (especially in the GameFi niche)

Meanwhile, BTC remains a store of value. For traders in Vietnam’s startup scene, Ethereum offers more interactivity and experimentation.

4. Is Bitcoin safer than Ethereum for long-term investment?

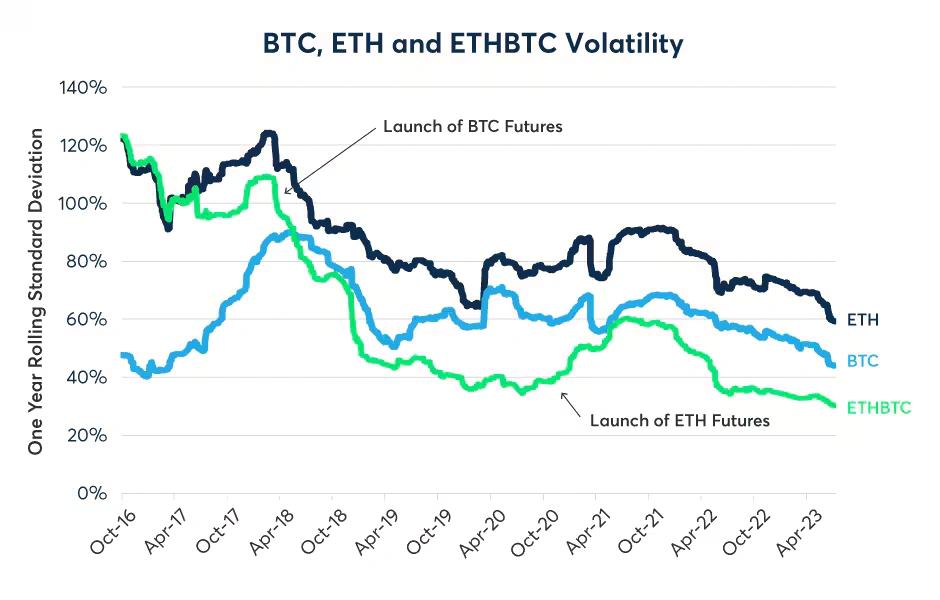

Credit from CME Group

Safety is relative. Bitcoin has a longer track record, a capped supply, and remains more widely adopted as a digital gold standard. That’s appealing to conservative Vietnamese investors.

However, Ethereum’s evolving use case makes it attractive to those who believe in tech growth. In other words, BTC is stability; ETH is innovation.

5. What do Vietnam-based crypto educators say about ETH vs BTC for beginners?

Credit from Bitcoin.com News

Many local crypto educators suggest beginners start with BTC, then branch into ETH as they understand the blockchain ecosystem better.

Platforms like Coin98, a Vietnam-born DeFi project, offer educational content explaining Ethereum’s layers and use cases — helping build trust in the network among newer investors.

6. Are local crypto trends shifting toward Ethereum in 2025?

Credit from vietnamnews.vn

Yes, especially among younger investors. With Vietnam ranked among the top crypto adopters globally, users are naturally moving toward applications — and that’s where Ethereum shines.

From staking on Binance VN to exploring DAOs via MetaMask, Ethereum growth in Vietnam is driven by real user behavior, not just hype.

7. What are the risks of Ethereum investment in Vietnam compared to Bitcoin?

Ethereum’s complexity — including its changing transaction fees, Layer 2 integrations, and governance challenges — introduces uncertainty.

For Vietnamese investors looking for simplicity and long-term value holding, BTC may feel safer. But for those willing to research and engage, ETH offers dynamic, interactive investment opportunities.

Conclusion: ETH vs BTC in Vietnam Isn’t About Competition — It’s About Intent

The crypto market in Vietnam is no longer just speculative — it’s evolving. Investors are more educated, more engaged, and more nuanced in their strategy.

The ETH vs BTC decision isn’t about which is better universally, but which aligns with an investor’s goals. For Ethereum believers, ethereum growth signals long-term potential, especially in markets like Vietnam where utility is actively shaping adoption.

In the end, whether you’re holding BTC for stability or exploring ETH for innovation, what matters is clarity of purpose — and a steady view on the future.