What Makes Forex in Thailand So Popular in 2025?

Forex trading in Thailand has seen rapid growth due to better regulations, improved platforms, and wider access to global markets. More Thai traders are joining the market thanks to user-friendly apps, local deposit options, and a growing base of financial education.

Which Forex Platforms Are Most Trusted in Thailand Right Now?

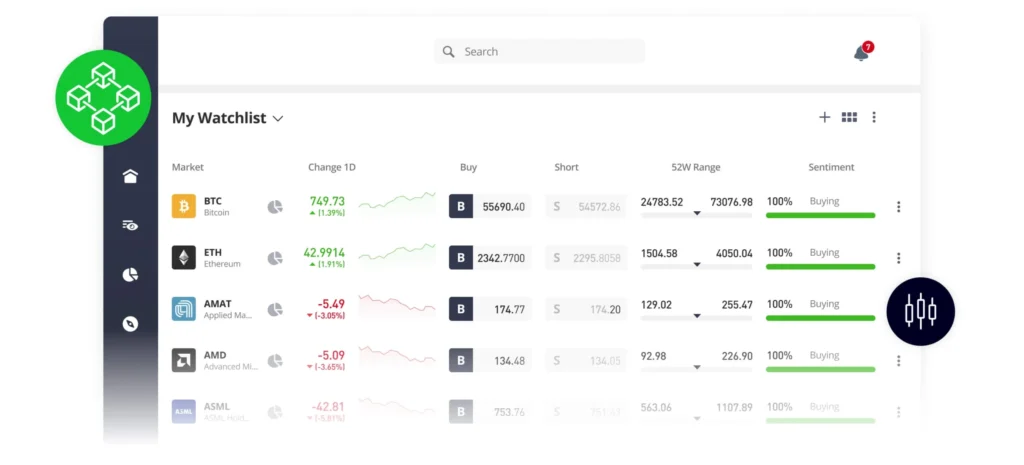

We’ve reviewed five standout platforms based on factors like regulation, usability, Thai-language support, fees, and features. Here’s how they compare.

Credit from : Sawasdee Thailand

1. What Is Exness and Why Is It Popular in Thailand?

Exness is a long-established platform in the Thai market. It offers full Thai-language support, local banking integration (e.g., SCB, Krungthai), and fast order execution.

Highlights:

- Regulated and reliable

- Local deposit/withdrawal options

- Low spreads

- Beginner-friendly interface

Drawback: Fewer advanced tools for experienced traders

Best for: Traders who value simplicity and local support

Credit from : Brokers Times

2. Is IC Markets Good for Low-Cost Trading?

Yes. IC Markets is known for its ultra-tight spreads—down to 0.0 pips—and fast execution speeds, making it ideal for active traders or scalpers.

Highlights:

- Raw Spread accounts with near-zero spreads

- Great for high-volume strategies

- Supports automated trading

Drawback: No Thai baht base currency and minimal localization

Best for: Experienced traders focused on performance and cost-efficiency

3. Does XM Offer Bonuses or Flexible Account Options?

It does. XM is widely used in Thailand and offers a no-deposit bonus for new Thai accounts. It also provides micro and standard accounts, along with educational resources.

Highlights:

- Regulated in multiple regions

- Thai-language support

- Promotions for Thai users

- Multiple account types

Drawback: Average spreads; some withdrawal limitations

Best for: Beginners and intermediate traders looking for flexibility

4. Is Octa a Good Choice for Mobile Forex Trading?

Yes, especially for mobile-first users. Octa (formerly OctaFX) appeals to younger Thai traders with its intuitive app and low minimum deposits.

Highlights:

- Clean mobile interface

- Ongoing local promotions

- Fast account setup

Drawback: Higher spreads than competitors; occasional slow support

Best for: New traders using mobile devices

5. What Makes eToro Stand Out in the Thai Market?

eToro offers a unique social trading environment, where users can copy strategies from top traders. It’s not fully localized for Thai users but offers strong educational potential through its community.

Highlights:

- Copy trading features

- Regulated and transparent

- Clean, easy-to-use interface

Drawback: Higher trading costs; limited Thai banking options

Best for: Beginners interested in learning through social and copy trading

Credit from : eToro

How Do I Choose the Right Forex Platform in Thailand?

Consider these criteria:

- Regulation: Is the platform licensed and trustworthy?

- Language & Support: Is there Thai-language customer service?

- Banking Options: Does it support local deposits and withdrawals?

- Trading Costs: What are the spreads and commissions?

- Tools & Features: Do you need educational resources, automation, or mobile trading?

Is Forex Trading Legal in Thailand?

Yes, Forex trading is legal in Thailand, but only with licensed brokers. The Bank of Thailand and the Securities and Exchange Commission (SEC) provide oversight, but many Thai traders use offshore brokers due to wider availability of tools and accounts.

What Should Beginners Be Aware Of in 2025?

- Always choose a regulated broker

- Start with a demo account if available

- Avoid using high leverage early on

- Be cautious with promotions that seem too good to be true

- Read the fine print on fees and withdrawal terms

Final Thoughts: Which Forex Platform Is Best for You in 2025?

There’s no single “best” option. Each platform suits a different type of trader.

- Choose Exness for simplicity and local convenience

- Try IC Markets for low spreads and fast execution

- Use XM for account variety and Thai-focused bonuses

- Pick Octa if mobile trading is your priority

- Explore eToro if you’re interested in learning by copying other traders

As Forex in Thailand grows in 2025, having the right platform is key. Take your time, test the options, and make sure the broker fits your goals—not just your budget.

Relevant Link : How to Choose the Best Forex Trading Platforms in Thailand (2025 Guide)