When you hear the term Forex Indonesia, you might think of online trading platforms and financial charts. But in reality, the phrase encompasses two very different services: speculative forex trading and practical money exchange. For many Indonesians, knowing when to use one over the other can be the difference between a safe, smooth experience — and an unnecessarily risky one. This tutorial helps clarify what each service does, how it works, and how to decide which fits your needs.

Forex Indonesia: What Is Forex Trading and How Does It Work?

Forex trading, also called currency trading, is the practice of buying one currency while simultaneously selling another — all done through an online platform. The aim is to profit from shifts in exchange rates. For instance, if you believe the US dollar will strengthen against the Indonesian rupiah, you might buy USD/IDR and then sell it when the rate rises.

In Indonesia, this is typically done through brokers that are licensed by BAPPEBTI, the national commodities and futures regulator. You start by opening a digital trading account, deposit funds (usually in rupiah), and use a platform or app to place your trades. Because the market runs 24 hours a day from Monday to Friday, traders can participate at almost any time, making it appealing for those with flexible schedules. However, this type of trading also involves risk, especially when leverage is used, allowing traders to control larger amounts of money with smaller deposits.

Forex Indonesia: What Does a Money Changer Do?

Source: Riauonline

A money changer is a physical outlet that allows people to exchange one type of currency for another — for example, swapping Indonesian rupiah for US dollars or Japanese yen. These services are especially popular among travelers, overseas students, migrant workers, or small businesses that need to deal in foreign currency.

Unlike forex trading, money changers operate face-to-face and involve actual cash transactions. Customers can see posted exchange rates, ask questions, and complete their exchange on the spot. The entire process is simple and fast. In Indonesia, all licensed money changers are regulated by Bank Indonesia, which requires them to follow clear rules regarding pricing, receipts, and anti-money laundering checks.

Forex Trading vs Money Changer: Key Differences

Source: Abu Sheikha

Although both deal with currency exchange, forex trading and money changers serve completely different functions. Forex trading is speculative — it’s an investment activity that depends on predicting future currency movements. It happens entirely online and can be affected by global news, interest rate decisions, or market sentiment. It’s not about obtaining cash for practical use — it’s about potential financial gain.

In contrast, a money changer helps people who need foreign currency for a specific purpose — such as a holiday, study abroad, or business payment. The process is immediate, with no speculation involved. Users are not exposed to financial risk because they simply buy a currency at a known rate and receive cash in return. This makes money changers ideal for one-time or short-term needs, while forex trading is more suitable for those looking to participate in global markets actively and repeatedly.

Forex Indonesia: When Should You Use a Money Changer?

Source: todayonline

If your situation requires physical currency — such as cash for travel, paying international school fees, or receiving remittances — using a money changer is usually the best choice. It’s straightforward, regulated, and doesn’t require any technical knowledge or digital access. You simply visit a licensed provider, check the rates, complete the transaction, and walk away with your foreign currency in hand.

This method is especially helpful for people who don’t want to deal with the complexity of trading apps or who are unfamiliar with financial risk. It’s also ideal for those who value transparency and prefer human interaction. For practical needs, money changers remain one of the most reliable parts of the Forex Indonesia ecosystem.

When Should You Use Forex Trading?

Source: Talk Business

Forex trading is better suited for individuals who are interested in financial markets and willing to invest time in learning. It allows you to trade currency pairs based on market analysis, technical indicators, or economic news. Some traders are in it for long-term investing, while others treat it as a short-term opportunity for income.

To trade effectively, you need to understand market behavior, be comfortable using trading platforms, and accept that losses are part of the process. Many platforms offer demo accounts, video tutorials, and news feeds to help beginners get started. That said, it’s essential to trade only with brokers licensed by BAPPEBTI, as unlicensed platforms may operate illegally and put your funds at risk. If you’re financially curious and can tolerate market uncertainty, forex trading could be a worthwhile path within the broader Forex Indonesia landscape.

Are Exchange Rates the Same?

Source: Kompas

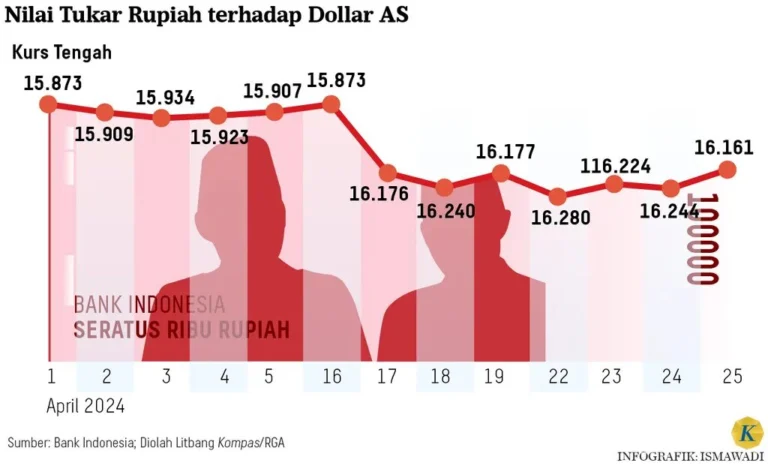

No — the rates can differ significantly between forex platforms and money changers. Money changers set their own rates, which include a markup or margin that serves as their profit. These rates may vary depending on location, currency availability, or volume. For example, a kiosk in a high-traffic tourist area might offer less favorable rates than one in a business district.

Forex platforms, on the other hand, use real-time interbank rates — the kind that major banks and institutions use. These rates fluctuate constantly and are generally closer to the market value. However, brokers often charge a spread (the difference between the buy and sell price) or add a commission to each trade. While forex trading may offer more accurate pricing, it also comes with fees and market exposure.

How to Stay Safe and Legal in Indonesia

Source: Bappebti

Whether you’re trading online or exchanging cash, staying within the legal system is crucial. In Indonesia, BAPPEBTI is responsible for regulating forex trading. Only brokers listed on their official registry are legally allowed to serve Indonesian traders. If you’re using a forex app, take the time to verify its licensing status.

For money changers, check that the outlet is registered with Bank Indonesia. Licensed providers display certificates and follow procedures designed to protect both the business and the customer. Avoid exchanging money through informal, unregistered services — even if the rates seem attractive — as these often carry legal and security risks. The best way to navigate Forex Indonesia is by working only with verified, regulated providers.

Conclusion: Knowing What Works for You

The world of Forex Indonesia spans both the modern world of online trading and the everyday convenience of physical money exchange. They might share the same category, but they exist for entirely different reasons. Use a money changer if you need foreign cash for travel or bills. Choose forex trading if you’re interested in global finance and ready to learn and manage risk.

By understanding these differences — and staying within regulated channels — you can make smarter, safer choices with your money, no matter which option you choose.