In uncertain times, one phrase keeps popping up in financial circles: gold hedge rupiah. But what does that actually mean — and how can regular Indonesians use it to protect their savings?

Gold has long been viewed as a safe haven. And when the rupiah weakens — whether due to global uncertainty, inflation, or local economic shifts — gold priced in rupiah often rises. That’s why gold is seen as a handy “hedge” or financial cushion. Here’s a clear, no-nonsense tutorial on how to do it.

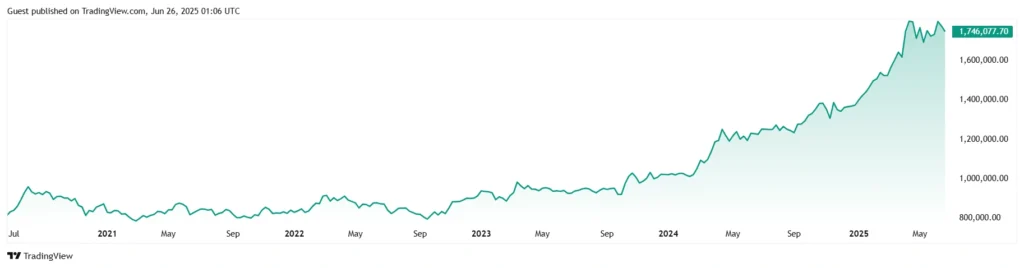

Step 1: Understand Why Gold Works as a Hedge Against the Rupiah

Gold is priced in US dollars. So, when the rupiah drops in value, the cost of gold in IDR goes up — even if gold prices in the global market stay flat. This means that holding gold can help preserve the real value of your money during currency depreciation. You’re not trying to get rich here — you’re trying to not lose purchasing power.

Step 2: Check the Current Economic Climate

Before jumping into gold, look around. Ask yourself:

- Is the rupiah weakening?

- Are imports getting more expensive?

- Is inflation pushing prices up at home?

- Is there global tension that could hit emerging markets?

If your answer to two or more of these is “yes”, then a gold hedge rupiah strategy might make sense.

Step 3: Choose the Right Type of Gold Investment

There’s no one-size-fits-all. Here are your main options:

• Physical Gold

Buy bars or coins (like from Antam) — a classic, safe route. But make sure you can store it securely.

• Digital Gold

Apps like Tokopedia Emas, Lakuemas, or Pluang let you buy gold in small amounts with just your phone. Very beginner-friendly.

• Gold ETFs or Mutual Funds

Perfect if you’re already investing online. These offer exposure to gold prices without physically owning it.

Tip: Don’t overthink it — just start with what feels manageable. Even 1 gram counts.

Step 4: Time Your Entry Wisely (But Don’t Obsess Over Timing)

Source: TradingView

Some people try to time the market. And yes, buying gold before a major rupiah drop is ideal — but don’t let perfect timing stop you from starting. Dollar-cost averaging (buying small amounts regularly) is a solid approach.

Remember: gold is for protection, not speculation.

Step 5: Keep an Eye on Fees and Liquidity

Not all gold options are created equal. Watch out for:

- High buying/selling spreads

- Hidden app fees

- Physical delivery charges

- Limited sell-back options

Make sure whatever gold you buy can be easily sold or converted back to rupiah when needed. Liquidity matters.

Step 6: Avoid Common Mistakes with Gold Hedging

Some missteps to steer clear of:

- Putting all your savings into gold (diversify!)

- Buying from unverified sources

- Forgetting to track local gold prices

- Ignoring global trends that could affect both gold and the rupiah

Gold is a hedge — not a miracle asset. Use it as part of a broader plan, not the entire plan.

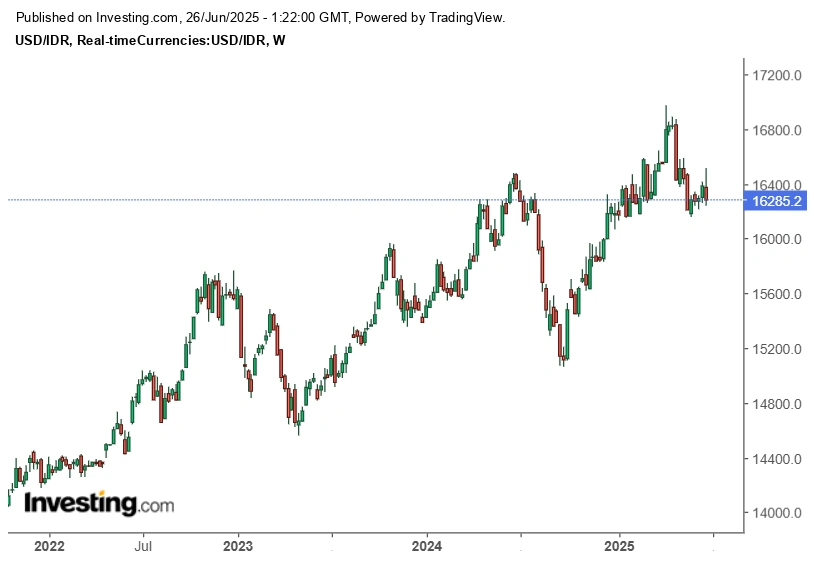

Step 7: Gold Hedge Rupiah- Monitor and Adjust Your Hedge as Needed

Source: Investing.com

Economic conditions change. So should your gold exposure. If the rupiah stabilizes and inflation eases, you might scale back. If things heat up again? Increase your position gradually. The key is staying aware — not frozen.

Final Thoughts- Gold Hedge Rupiah

Using gold as a gold hedge rupiah strategy isn’t just for big investors — anyone can do it, even with a small starting amount. In 2025, with economic uncertainty still a factor, it’s one of the simplest ways to add some protection to your savings.

It’s not about fear. It’s about being prepared.