MACD RSI for Forex Indonesia: To trade effectively in Indonesia’s forex market, you need more than just market sentiment or economic news. Price patterns can change quickly, influenced by both local factors like Bank Indonesia decisions and global shifts in commodity prices or interest rates. Technical indicators help traders stay grounded. They offer structure and clarity — a visual breakdown of how the market is moving and where momentum may be building or fading. Among these tools, MACD RSI for Forex Indonesia has stood out for being both simple and powerful. These indicators give traders a way to spot potential entry and exit points with more confidence, reducing the need to guess what might happen next.

Learn How MACD Works and When to Use It

MACD, which stands for Moving Average Convergence Divergence, is used to measure momentum and trend direction. It’s built from two moving averages — the 12-period EMA and the 26-period EMA — and a signal line that triggers alerts when the MACD line crosses above or below it. Indonesian traders often turn to MACD during key decision points: such as before entering a trade, after a breakout, or around significant economic releases like inflation reports or interest rate updates. For example, when the MACD line crosses above the signal line and the histogram turns positive, it suggests bullish momentum — something many traders watch for during active hours in the Asian or European sessions.

Apply RSI to Confirm Momentum and Avoid Overreaction

Source: LiteFinance

The Relative Strength Index (RSI) is another popular tool that shows how strong recent price movements are — especially useful in fast-changing markets like Indonesia’s. RSI is displayed as a number between 0 and 100, with readings above 70 considered overbought and below 30 considered oversold. RSI helps traders avoid emotional reactions to sudden price changes. For instance, if a spike in USD/IDR occurs due to external news, RSI can confirm whether this move has real strength or is likely to reverse. For Indonesian traders who follow pairs affected by regional politics or export data, RSI offers a data-driven way to avoid chasing false trends.

Combine MACD and RSI for More Reliable Signals

While both MACD and RSI are useful individually, using them together offers better signal confirmation. MACD shows trend direction, while RSI shows momentum — and when both point in the same direction, that can validate a trade decision. Indonesian traders often wait for both to align before opening a position. For example, if MACD shows a bullish crossover and RSI is still under 70 but rising, it’s a sign that there’s still room for the move to continue. On the flip side, a bearish MACD crossover with a falling RSI under 50 can signal a weakening market. This two-step confirmation process helps filter out false signals, which is especially valuable during volatile trading sessions.

Add Bollinger Bands to Track Volatility and Entry Points

Bollinger Bands are another helpful tool to use alongside MACD and RSI. They consist of a moving average and two lines above and below it that expand or contract with price volatility. In Indonesia’s forex market — which often reacts to external pressures like oil prices or Fed statements — these bands help traders understand when price action is stretched. A touch of the upper band with RSI near 70 and a slowing MACD can be a warning that the trend may be losing steam. On the other hand, a price touching the lower band with rising RSI and a bullish MACD crossover can hint at a possible reversal. When used correctly, Bollinger Bands add timing precision to trades.

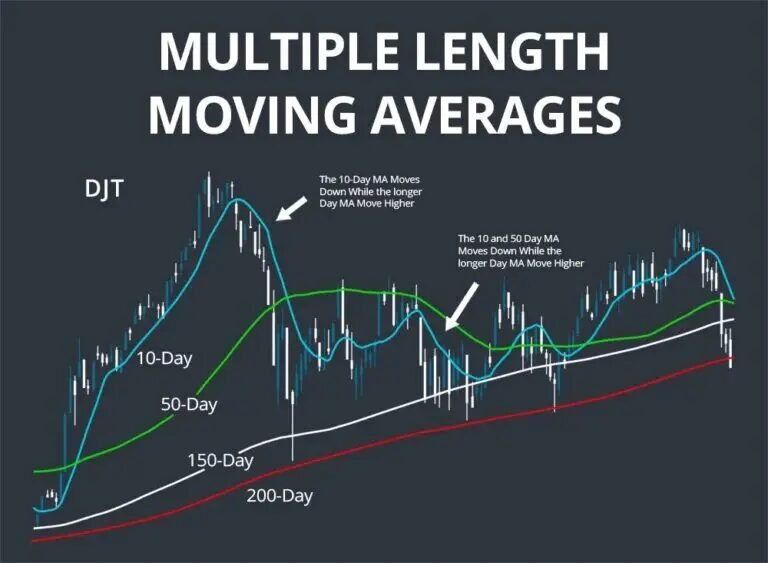

Use Moving Averages to Track Long-Term Trend Direction

Source: SCANZ

Moving averages — whether simple or exponential — smooth out price data and highlight long-term trends. In Indonesia, where forex pairs like AUD/IDR or USD/IDR often move in waves, moving averages can show when a trend is beginning or ending. For instance, a crossover of the 20-day EMA above the 50-day EMA may signal a bullish trend, especially when RSI supports momentum and MACD confirms direction. Many Indonesian traders use moving averages as a filter before committing to a trade, particularly in less liquid hours. By combining moving averages with MACD RSI, you ensure that all tools are pointing in the same direction — increasing your trade confidence.

MACD RSI for Forex Indonesia: Add Stochastic Oscillator for Entry and Exit Timing

The stochastic oscillator is useful for identifying short-term price reversals. It compares closing prices to their recent range and is especially favored by day traders and scalpers in Indonesia. When the %K line crosses the %D line below 20, it often signals oversold conditions — a potential opportunity to buy if MACD and RSI also align. Conversely, crossovers above 80 may suggest overbought zones. Stochastic is quick and sensitive, so it works best when used with slower indicators like MACD and RSI. In the Indonesian market, where news can suddenly change sentiment, stochastic helps pinpoint when a move might be running out of steam.

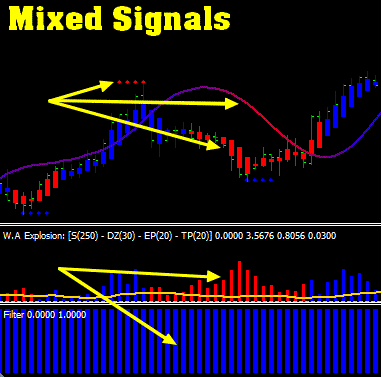

MACD RSI for Forex Indonesia: Avoid These Common Mistakes When Using Indicators

Source: Forexstratergies

One of the biggest mistakes Indonesian traders make is using indicators without context. For example, blindly following a MACD crossover during a low-volume session or when key economic data is due can lead to losses. Another common error is relying on too many overlapping indicators that give mixed signals, leading to confusion. Indicators should guide your decisions, not make them for you. Always cross-check with the economic calendar, regional news, and market sentiment. The most effective use of MACD RSI for Forex Indonesia comes from integrating them into a broader trading system — one that includes risk management, patience, and a willingness to wait for high-quality setups.

MACD RSI for Forex Indonesia: Use MACD and RSI With Confidence in 2025

As we move deeper into 2025, tools like MACD RSI for Forex Indonesia continue to hold relevance. They’re easy to learn but flexible enough for advanced strategy development. Whether you’re new to forex or refining an existing approach, MACD and RSI offer a consistent framework for market analysis. In a fast-paced environment shaped by both local and international factors, these tools help you stay focused. When combined with other indicators like Bollinger Bands, moving averages, or stochastic oscillators, they provide the structure you need to trade with discipline. In the hands of informed Indonesian traders, MACD and RSI remain essential components of successful forex strategies.