For anyone entering the forex market, the biggest challenge is knowing where to begin. Signals come from every direction, data can feel overwhelming, and risks are ever-present. The Prorex Indicator was developed to bring structure to this process, offering both clarity and practicality. From newcomers trying out a Prorex free credit to experienced professionals managing portfolios. Through Prorex PAMM trader systems, the indicator serves as a roadmap. This step-by-step guide looks at how traders can integrate the tool into their daily strategies and why it has become a trusted name among the best trading indicators 2025.

Step 1: Setting the Foundation With Prorex Indicator

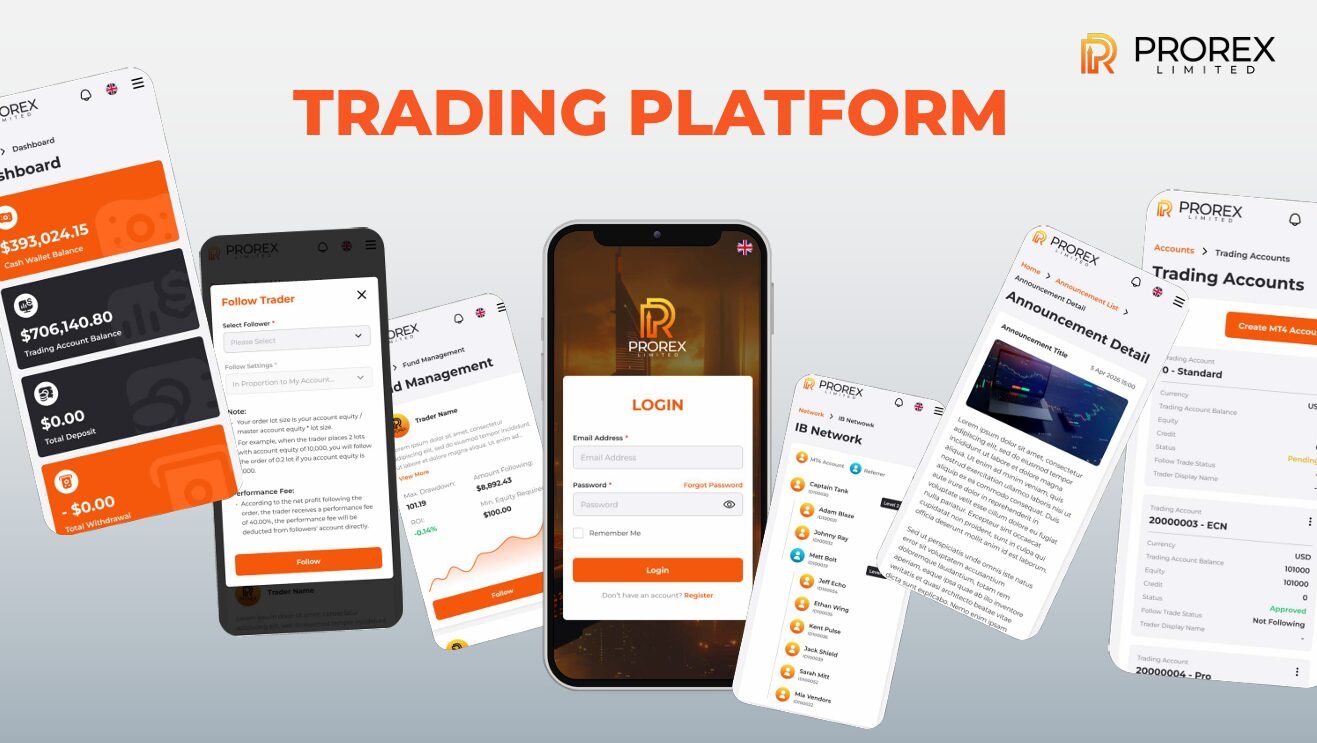

Before any trade can be made, clarity is key. The Prorex Indicator for forex trading acts as a real-time trading indicator. Helping traders make sense of movements in the market without second-guessing themselves. For beginners, it doubles as a forex indicator for beginners, stripping away unnecessary complexity while highlighting key opportunities.

A trader using a Prorex free bonus might start by observing how signals appear in live market conditions. Others who trade under Prorex low spread conditions benefit from the precision the indicator provides. This first step — building confidence in reading the market — is where many traders begin to feel in control of their own decisions.

Step 2: Prorex Indicator Managing Risks and Applying Strategy

Once traders become comfortable with signals, the next stage is discipline. Markets are fast-moving, and without structured controls, even the best strategies can fail. The Prorex Indicator strategy guide emphasizes its role in risk management in forex trading. Ensuring signals are not treated as standalone shortcuts but as part of a broader framework.

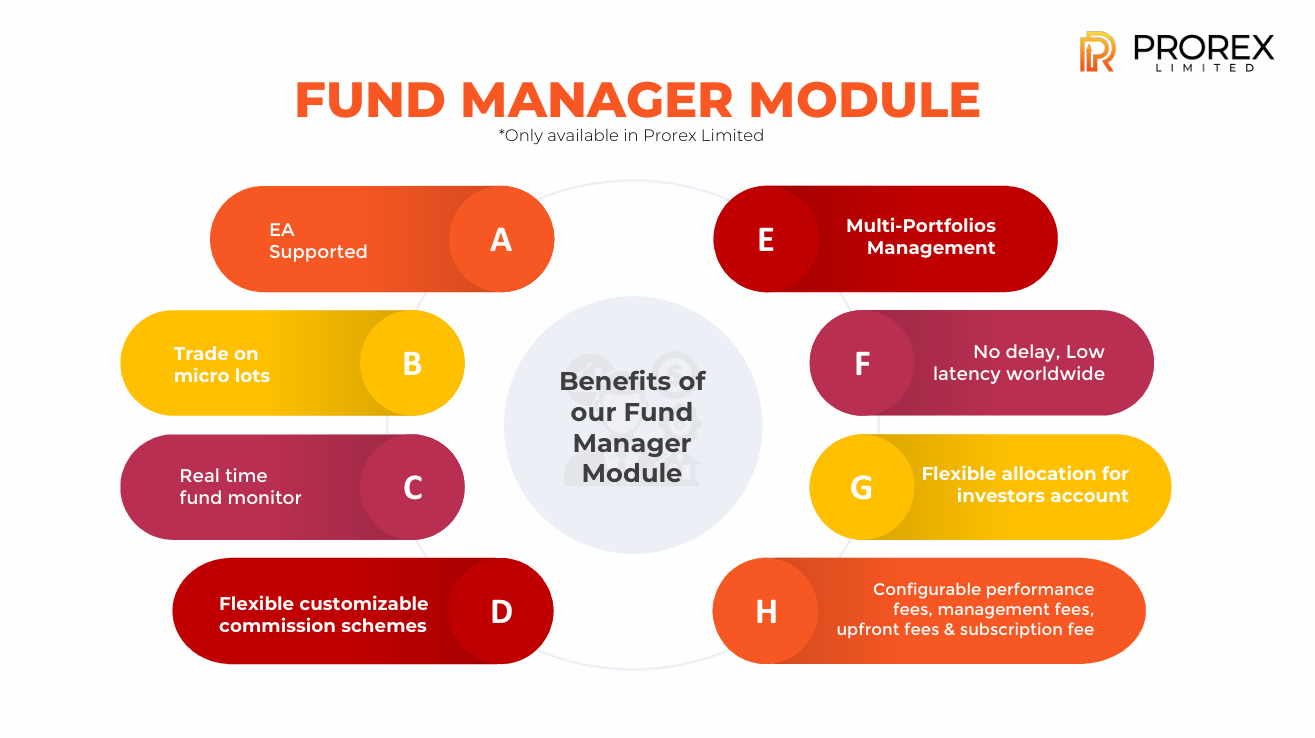

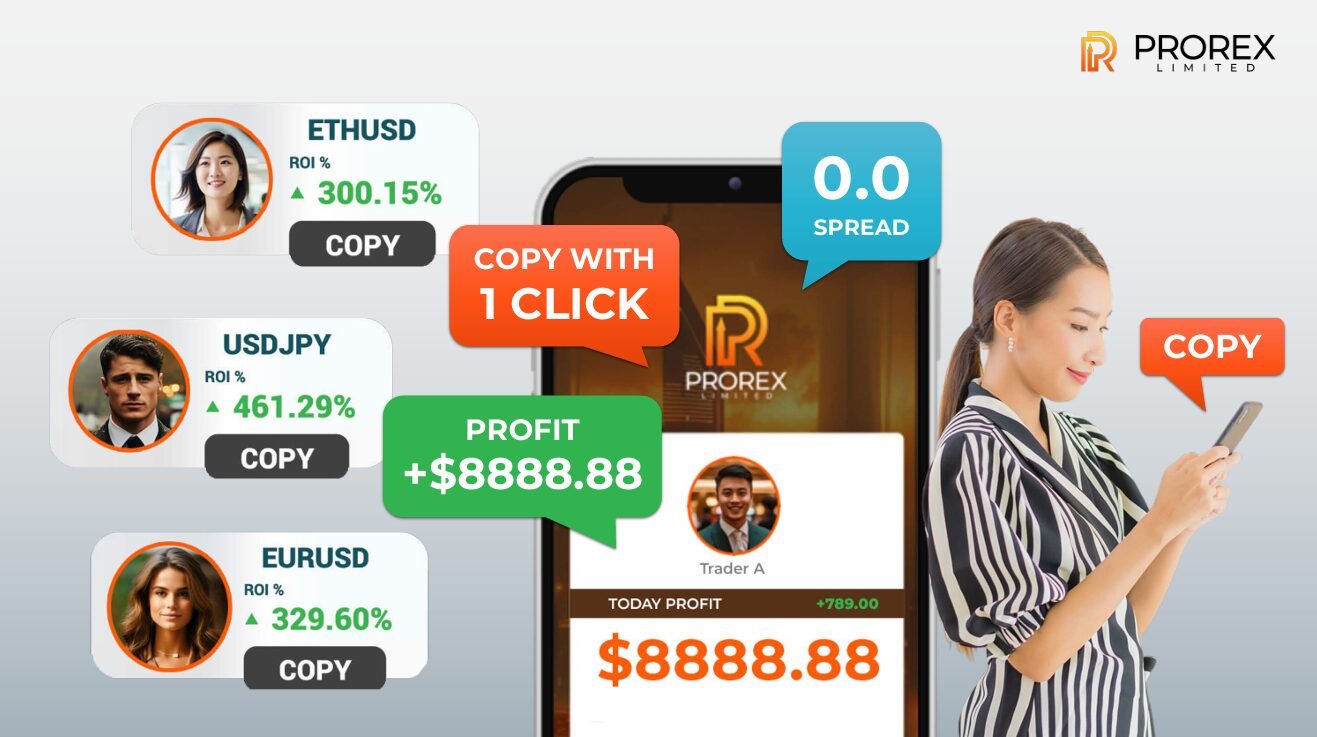

Portfolio managers using Prorex PAMM solutions explained how the tool supports multiple accounts at once by functioning as a trend analysis indicator. Meanwhile, those engaged in copy trading strategies find it especially useful as a checkpoint — validating whether trades they follow align with sustainable trends. In both cases, the second step of applying strategy with discipline is where the indicator proves its long-term value.

Step 3: Expanding Into Shared and Automated Models

The final step is scaling beyond individual trades. Many traders today are exploring opportunities in the Prorex Revenue share program, Prorex copy trading, or even Prorex AI trading. The Prorex Indicator is designed to complement these paths by ensuring consistency and transparency.

For those joining copy trading, the tool provides real-time validation of a provider’s performance. For fund managers, it aligns with allocation methods in PAMM and MAM accounts. And for traders experimenting with automation, the indicator acts as a safeguard, ensuring algorithms remain in step with real market data. This step of expansion demonstrates how the indicator is not only a beginner’s tool but a future-facing companion for professional growth.

Conclusion: From First Steps to Future Growth

The Prorex Indicator simplifies what often feels like a complicated journey. It starts by helping beginners read signals with confidence, progresses into structured risk management, and finally integrates into broader systems such as copy trading and portfolio management. By offering real-time clarity, consistency, and transparency, it is more than just a technical tool — it is a step-by-step guide to sustainable trading. In 2025, when forex demands both speed and structure, the indicator stands out as a practical solution for traders ready to grow.

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia