In the fast-moving world of online investments, investors are increasingly seeking ways to combine professional expertise with personal control. This is where Prorex Pamm enters the picture. Rather than being just another trading tool, it offers a structured system designed for transparency, adaptability, and collaboration. In this guide, we walk through how it works and why it is becoming an important option for traders and investors in 2025.

Step 1: Understanding the Prorex PAMM System

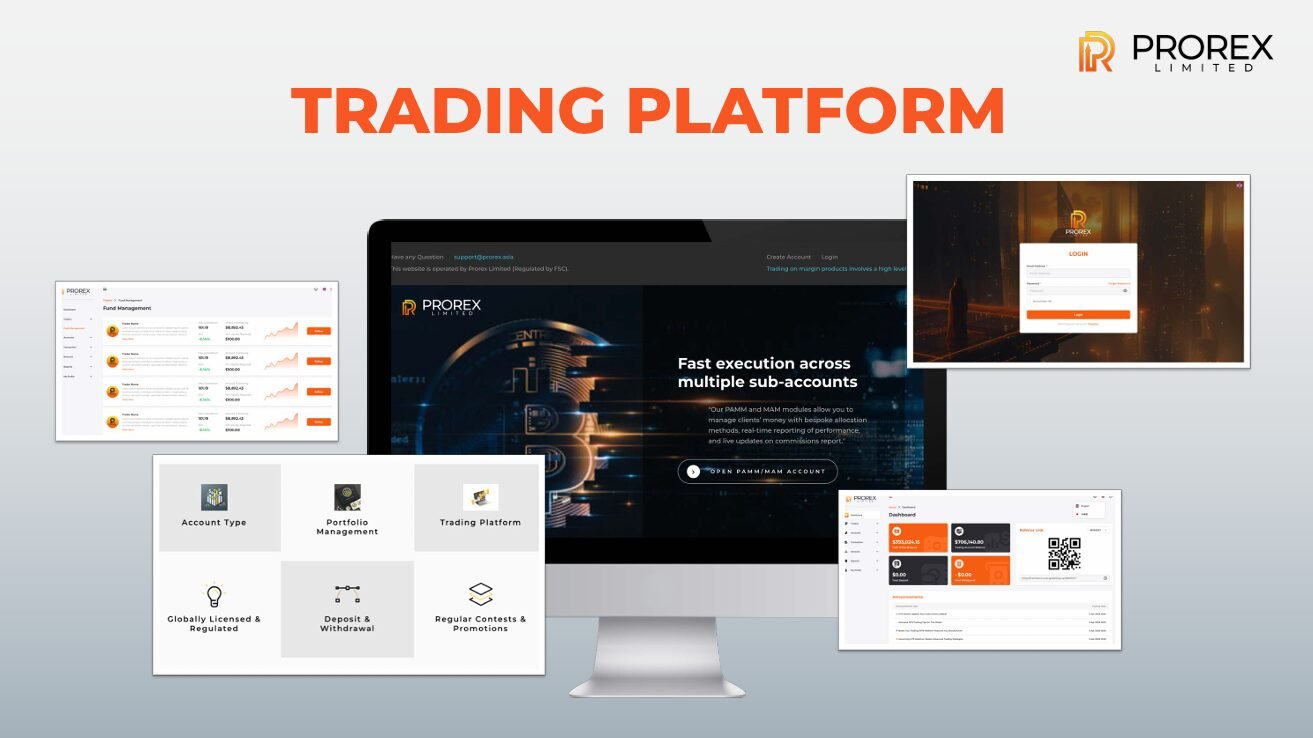

The first step is knowing what Prorex Pamm trading really is. PAMM stands for Percentage Allocation Management Module, a framework that lets investors allocate funds to skilled managers while still retaining oversight. Unlike traditional funds where investors often feel detached, the Prorex Pamm system updates performance in real time, making results visible and easy to follow.

Traders managing accounts benefit from advanced features like Prorex AI trading, Expert Advisors (EA), and Prorex indicators, while investors gain from Prorex low spread conditions. With customizable allocations and fee structures, both sides of the equation find flexibility that fits their needs. This first step is all about clarity: knowing that control is shared, not lost.

Step 2: Exploring Copy Trading and Revenue Sharing

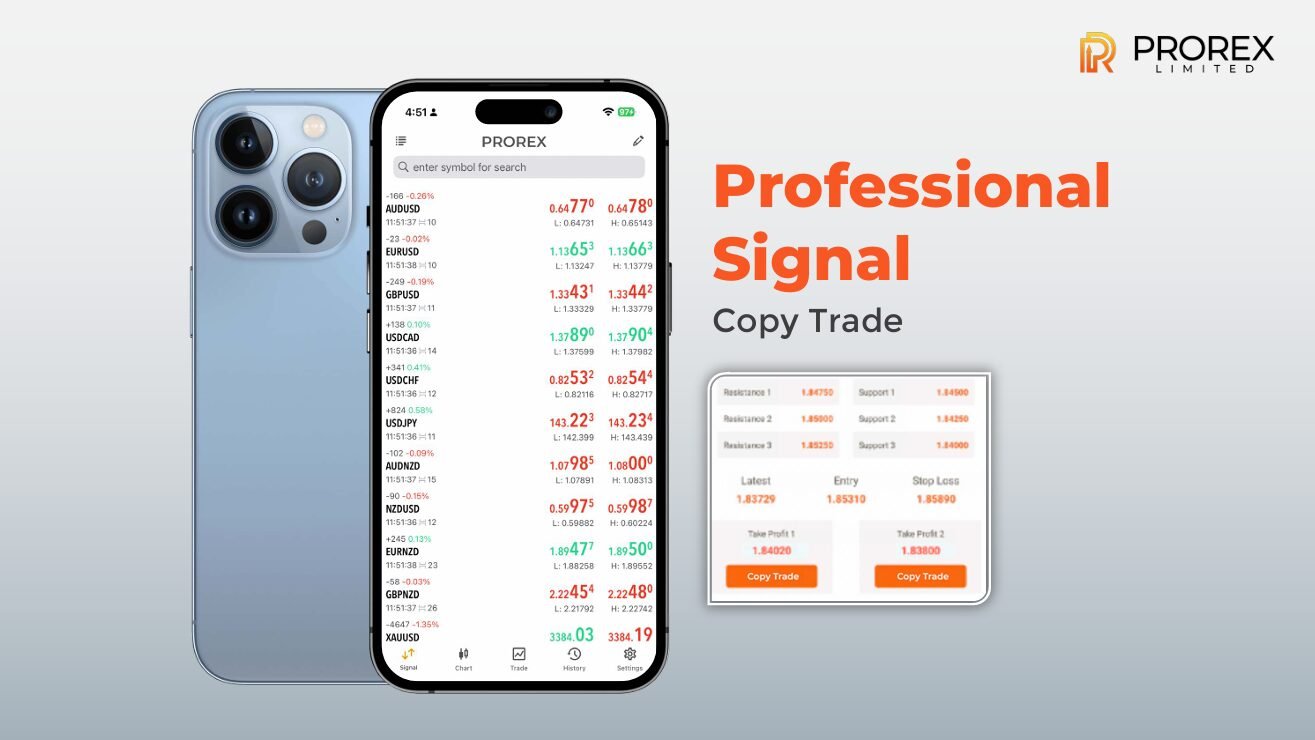

The next step is discovering how Prorex extends beyond PAMM with its copy trading platform. For investors who prefer not to trade actively, Prorex copy trading allows them to mirror the strategies of experienced traders. What makes it different is transparency — performance histories, strategy details, and risk profiles are openly available before any decision is made.

For strategy providers, this step introduces opportunity. Through the Prorex revenue share program, traders earn not only from their own performance. But also from the community of followers who trust their strategies. Promotions like Prorex free credit and Prorex free bonus lower the entry barrier. Making it easier for newcomers to test the waters while still learning from seasoned professionals.

Step 3: Building for the Future with a Prorex PAMM Account

The final step is recognizing why a Prorex PAMM account matters today and in the years ahead. With its multi account manager (MAM) module, managers can oversee multiple portfolios, customize performance fees, and adjust trading conditions. This ensures scalability for professionals while keeping investors informed through real-time reporting.

It is also about future-readiness. As discussions around the best PAMM broker 2025 highlight, platforms that combine low latency, flexible allocation, and reliable oversight are the ones likely to stand out. By supporting micro lots for beginners and complex strategies for professionals. The Prorex PAMM account adapts to diverse lifestyles and financial goals.

Conclusion: Prorex PAMM as a Guided Path to Smarter Trading

Following these steps shows why Prorex Pamm is more than just another managed trading tool. It simplifies entry into structured portfolio management. Enhances collaboration through copy trading, and prepares investors for the future with scalable PAMM and MAM solutions. The strength of Prorex lies in its ability to guide investors and traders alike through a transparent, flexible, and human-centered approach — one step at a time.

【 Prorex Limited 】

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia