For newcomers and seasoned traders alike, entering global markets can feel daunting. That’s why tools like Prorex Pamm Trader have gained traction—offering a structured, transparent way for investors to participate in forex and CFD markets without the pressure of making every decision themselves. To better understand how it works, let’s break it down step by step.

Step 1: Understanding the Basics of Prorex Pamm Trader

The journey begins with knowing what a PAMM account actually is. PAMM stands for Percentage Allocation Management Module. In simple terms, it allows investors to allocate their funds to professional managers, who then trade on their behalf. With Prorex Pamm Trader, every investor’s contribution is pooled, and profits or losses are distributed proportionally.

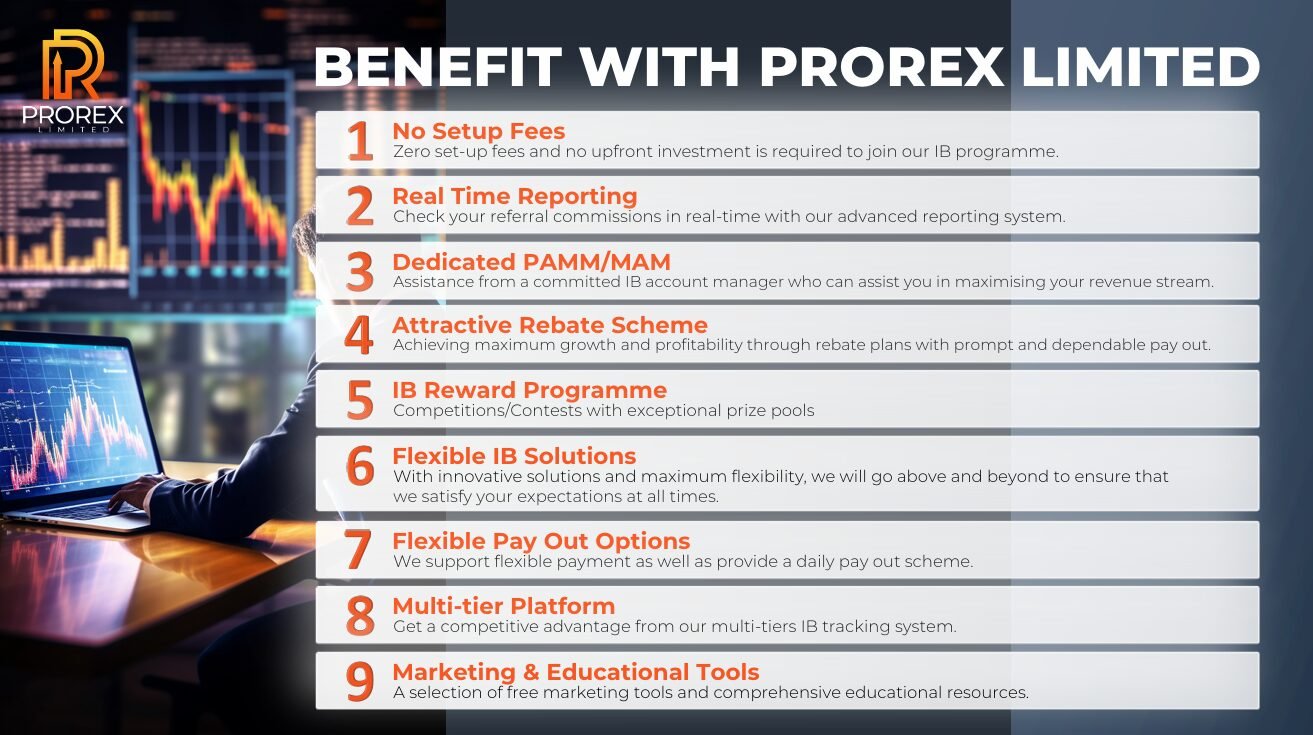

Prorex Limited enhances this model by embedding it into a regulated framework under the Mauritius FSC. Investors benefit from transparency on fees—whether performance, management, or subscription—before they ever commit funds. By providing ultra-low spreads, lightning-fast execution, and access to MetaTrader 5, the platform sets a strong foundation for efficient, professional-level investing.

Step 2: Choosing Between PAMM and Copy Trading

One of the most common questions investors ask is how PAMM differs from copy trading. The answer lies in structure. Copy trading allows a user to mirror trades in real time, while Prorex Pamm Trader organizes funds into pooled accounts, distributing results fairly based on allocations.

With Prorex, both models are available. Investors who want direct trade replication can opt for copy trading, while those looking for a more strategic, long-term approach can turn to PAMM accounts. Each option comes with real-time reporting, EA (Expert Advisor) support, and access to a wide variety of products, ensuring flexibility no matter the investor’s style.

Step 3: Managing Risks and Maximizing Benefits

No guide would be complete without addressing risk. Even with professional managers, markets remain volatile. The key advantage of Prorex Pamm Trader is that it equips investors with the tools to make informed choices. Strategy providers’ track records are visible, performance histories are updated in real time, and allocations can be adjusted to match individual risk tolerance.

For investors, the benefits include diversification, the possibility of passive income, and relief from the stress of constant monitoring. For managers, the platform offers customizable conditions, from performance fees to trade parameters, and the chance to grow their network through Prorex’s leaderboard feature. Together, this creates a balanced ecosystem that fosters trust and confidence.

Conclusion: Building a Smarter Path Forward with Prorex Pamm Trader

Investing in forex no longer needs to be an all-or-nothing challenge. With its structured design, regulated framework, and transparent systems, Prorex Pamm Trader gives investors a step-by-step way to engage with markets thoughtfully. It does not eliminate risk, but it provides clarity, tools, and professional support that turn uncertainty into strategy. For anyone looking to take part in global trading with confidence, Prorex offers a future-focused path worth considering.

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia