Step 1: Understand What the Rupiah Forecast 2025 Really Means

The Rupiah Forecast 2025 refers to projected trends and potential price movement of the Indonesian Rupiah (IDR), particularly against major currencies like the USD. These forecasts aren’t crystal balls, but they are grounded in economic data, central bank policy, and investor behavior. Understanding the IDR’s likely direction requires paying attention to multiple layers: domestic performance, global risk appetite, trade balances, and how institutions like Bank Indonesia respond. Forecasts help businesses hedge risk, help investors time their exposure, and offer everyday consumers insight into how their currency is holding up in a shifting world economy.

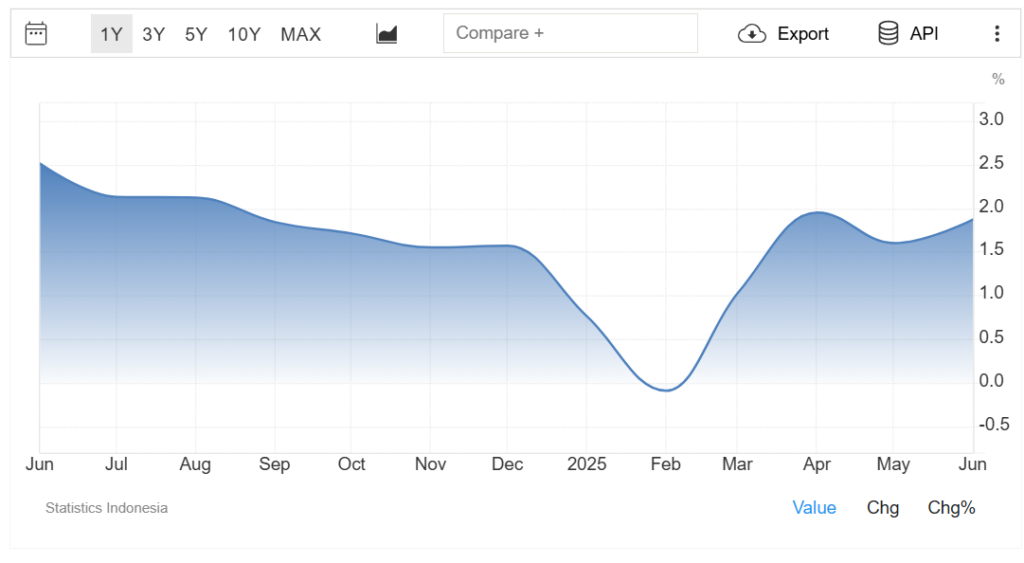

Step 2: Identify the Risks That Could Weaken the Rupiah

Source: TradingEconomics

To read any Rupiah forecast 2025 effectively, start by identifying what could cause the IDR to lose value. One of the biggest threats comes from global monetary policy — particularly the U.S. Federal Reserve. If the Fed maintains high interest rates, investors might pull capital from emerging markets and place it into higher-yielding U.S. assets, weakening the Rupiah. On the domestic front, inflation spikes, increased fuel subsidies, or deteriorating trade numbers could also trigger downward pressure. Even if Indonesia’s economy remains stable, external shocks like geopolitical conflict or declining global growth could tip the balance. In short, risk factors often travel in packs — and they rarely wait their turn.

Step 3: Recognize What Might Strengthen the Rupiah

Despite global headwinds, the IDR does have supportive factors working in its favor in 2025. If global inflation moderates and developed markets begin loosening monetary policy, capital could flow back into higher-yielding emerging markets — including Indonesia. The country’s consistent trade surplus, low external debt, and improving infrastructure outlook give investors some confidence in the long-term trajectory of the economy. If Bank Indonesia maintains disciplined monetary policy and communicates effectively with markets, the Rupiah could gain ground. The real question is timing — whether supportive conditions materialize early or late in the year will impact how much strength the currency can build.

Step 4: Factor in Indonesia’s Domestic Economic Conditions

A major part of the Rupiah forecast involves reading Indonesia’s own economic fundamentals. The country has remained relatively stable compared to many peers, with steady GDP growth and manageable inflation. However, much of Indonesia’s foreign exchange strength depends on exports, especially in commodities like coal, palm oil, and nickel. If global demand holds, this can support the currency. Domestic consumption also plays a part — when Indonesians spend more, it boosts business and tax revenue, indirectly strengthening the IDR. Still, economic management matters: unexpected policy shifts or fiscal slippage can quickly erode confidence, even when macro numbers look fine on paper.

Step 5: Understand Bank Indonesia’s Role in Managing Currency

Source: ANTARANEWS

No Rupiah forecast 2025 would be complete without considering the role of Bank Indonesia, the country’s central bank. It controls interest rates and often intervenes directly in currency markets to limit sharp volatility. In recent years, the bank has moved cautiously, aiming to preserve stability while reacting to global conditions. This year, it faces a tightrope walk: keeping inflation under control while avoiding actions that might scare off foreign investors. A steady tone, timely decisions, and strong FX reserves all help build trust. For investors and analysts, closely watching central bank statements, rate decisions, and forward guidance will be essential.

Step 6: Monitor the Bigger Global Trends That Influence IDR

Source: Coincodex

Zooming out, the Rupiah outlook is tightly linked to broader global economic forces. Changes in global oil prices can either help or hurt the IDR, depending on how they impact Indonesia’s energy imports and exports. Trade tensions or political shocks — from the South China Sea to European elections — may send investors looking for safe havens, often to the U.S. dollar. When that happens, the IDR can weaken, even if Indonesia isn’t directly involved. That’s why global headlines matter just as much as local news when tracking the Rupiah. Currencies don’t operate in isolation — they react to capital flows, market confidence, and systemic risks.

Step 7: Rupiah Forecast 2025- Compare the Rupiah with Other Emerging Market Currencies

A good way to understand IDR’s position is to compare it within the emerging market currencies outlook 2025. Some currencies — such as the Turkish lira or Argentine peso — face much higher volatility due to political risk or runaway inflation. The Rupiah, in contrast, is seen as relatively moderate: not completely sheltered, but supported by sound macroeconomic policy. However, when global investors exit EM assets, the IDR is often caught in the wave, regardless of Indonesia’s own metrics. Keeping an eye on how other emerging currencies are moving can help anticipate whether the IDR is tracking broader trends or following its own path.

Step 8: Rupiah Forecast 2025- Apply the Forecast to Your Strategy or Decisions

Whether you’re an investor, a business owner, or simply trying to budget for overseas costs, the Rupiah forecast 2025 has practical value. Businesses with exposure to imports or exports can use forecasts to plan hedging strategies or manage price risk. Investors may choose to adjust their portfolio exposure — through bonds, equities, or FX products — depending on their confidence in the IDR. For individuals, the forecast can shape decisions around travel, savings, or foreign purchases. In any case, the key is not to rely on any single prediction. Instead, treat the forecast as a set of evolving signals that can help you act with more confidence — not certainty.