Trading Journal Indonesia: Regardless of your trading instrument—forex, stocks, or crypto—a trading journal remains one of the most effective tools for improving performance. Many traders in Indonesia often trade based on emotion or impulse. A journal helps shift that behavior toward discipline and strategy. By documenting your trades and reflecting on your decision-making process, you can spot patterns, identify consistent mistakes, and fine-tune your techniques over time. This ongoing analysis gives you more control over your trading results and helps prevent repeated losses caused by emotional or inconsistent decision-making.

Getting Started: What a Trading Journal Really Is

A trading journal is more than just a record of trades. It’s a personalized tool that captures the logic, emotion, and technical context behind each trading decision. A well-kept journal should include essential trade data such as the date and time, asset traded, position size, entry and exit points, stop-loss, take-profit, trade outcome, and notes on market conditions. Equally important is recording your emotional state and confidence level at the time of the trade. These details can reveal psychological patterns that influence your performance just as much as your technical strategies do.

Choose the Right Format for You

There’s no single best format for keeping a trading journal—it depends on your workflow. Many Indonesian traders prefer using Excel or Google Sheets because they’re customizable and accessible. You can build your own formulas, apply color coding, and categorize your trades by strategy, asset type, or outcome. For those who want more automation, apps like Edgewonk, Trademetria, or TraderSync offer built-in analytics, emotional tagging, and strategy testing tools. If you’re trading crypto, platforms like CoinMarketMan can integrate with exchanges to auto-import data while still allowing manual notes.

Key Elements to Include in Your Journal

Source: Investing.com

An effective trading journal should contain both objective data and subjective reflections. Important columns or fields may include:

- Trade date and time

- Instrument traded (e.g., EUR/USD, BTC/IDR, IDX stocks)

- Direction (long or short)

- Entry and exit price

- Stop-loss and take-profit

- Position size and leverage

- Trade outcome (profit/loss)

- Strategy or setup used

- Pre-trade notes and emotional state

- Post-trade analysis or lessons learned

Tracking this information consistently allows you to understand which setups work best, when you trade well, and what factors lead to poor decisions.

Trading Journal Indonesia: The Importance of Recording in Real Time

Source: Shifting Shares

One of the most powerful habits you can develop is recording trades as soon as they’re executed or closed. This ensures you capture the full context of the trade—including your emotions, rationale, and surrounding market conditions—without forgetting key details. If you wait until later, you may unintentionally alter the truth due to hindsight bias. Keeping your journal open during trading hours also makes it easier to jot down pre-trade plans and expectations, which can later be compared to the actual result for more accurate evaluations.

Trading Journal Indonesia: Reviewing and Analyzing Your Trading Journal

Keeping a journal is only half the task—reviewing it is where the value truly lies. Set aside time weekly or monthly to go through your entries and look for patterns. Are certain strategies consistently profitable? Do specific market conditions affect your results? Are emotions like fear or overconfidence hurting your decisions? Use charts or graphs if you’re using Excel or journaling software to visualize your performance trends. A proper review process allows you to refine your edge and eliminate mistakes more effectively than simply relying on memory.

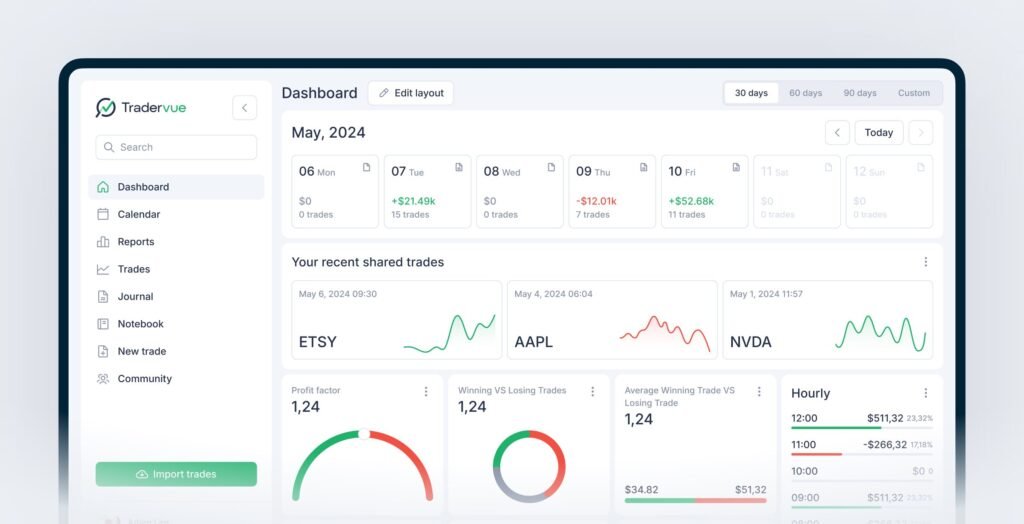

Trading Journal Indonesia: Customizing with Templates and Tools

Source: Tradervue

To make journaling easier, consider starting with a trading journal template. Many templates are designed for specific trading styles, such as day trading, swing trading, or crypto trading. Indonesian traders can use Google Sheets templates with built-in calculations for R:R ratios, win rates, and monthly summaries. Tools like Notion or Trello can also be customized into interactive trading journals, especially for those who prefer more visual organization. You can also add chart screenshots or voice notes for deeper trade reviews.

Crypto Traders in Indonesia: Things to Note

Source: Tynmagazine

For those trading crypto, a journal becomes even more crucial due to the market’s 24/7 nature and higher volatility. Record key details like network fees, slippage, funding rates, and the exchange used. Crypto trading often happens outside regular hours, so it’s essential to note your alertness or fatigue level during late-night trades. Some Indonesian crypto traders use apps that sync with platforms like Pintu, Tokocrypto, or Binance to automate data entry but still maintain the habit of reflective journaling.

Make It a Habit, Not a One-Time Task

A trading journal delivers value only when used consistently. Treat it as an integral part of your trading process, not an afterthought. Set reminders after each trading session to fill out your journal. Schedule a weekly review session and stick to it. Over time, journaling becomes second nature and offers unmatched insight into your growth, risk tolerance, and execution habits. Just as athletes review game footage, traders review journals to sharpen their edge.

Conclusion: Your Trading Journal, Your Growth Engine

Building and maintaining a trading journal might seem like a lot of work at first, but it pays off in the long run. For traders in Indonesia, it’s not just about logging trades—it’s about developing discipline, consistency, and a structured path to improvement. Whether you use Excel, journaling apps, or a notebook, the key is to make the journal work for you. Start small, stay consistent, and review regularly. Your trading journal isn’t just a logbook — it’s your personal roadmap to becoming a more successful and confident trader.