Trading Mistakes Beginners Indonesia: Trading in the financial markets, particularly forex and crypto, is becoming a popular side hustle and income stream in Indonesia. With many influencers showing off trading profits on social media, it’s easy to believe that success is just a few trades away. Unfortunately, many new traders dive in without a clear understanding of the risks involved. They often rely on instinct rather than preparation, leading to repeated losses and growing frustration. These early mistakes not only drain capital but also damage confidence. That’s why it’s crucial to identify and address the trading mistakes beginners Indonesia commonly fall into—because recognizing these patterns is the first step to becoming a better trader.

Skipping Demo Trading and Jumping Into Real Markets

One major pitfall for new traders is the eagerness to start trading with real money before mastering the basics. Many underestimate the learning curve involved and think they can “figure it out as they go.” Unfortunately, the live market is unforgiving. Without understanding order types, market volatility, or how to execute a strategy, it’s easy to lose money quickly. Demo trading is designed to help new traders learn how the platform works, develop consistency, and build confidence—all without financial risk. If you’re just starting out, take time to simulate trades and practice discipline. In Indonesia’s active trading scene, avoiding this step is one of the most common reasons why beginners lose funds early.

Using Too Much Capital on Day One

Source: ION

Another serious mistake is starting with large capital in hopes of making big profits fast. This approach usually backfires. With high emotional pressure and no experience, it’s easy to panic when trades don’t go your way. New traders often lack a proper plan and end up risking too much on a single trade, leading to account blowouts. Starting small has many advantages—it reduces psychological stress, allows you to learn from your mistakes, and keeps losses manageable. Many successful traders in Indonesia started by trading micro-lots or using small position sizes to gain experience without risking their entire budget. Remember, consistency beats speed in the long run.

Trading Without a Well-Defined Plan

Many beginners begin trading based on emotions or tips from social media, without any concrete plan. They don’t have set rules for when to enter or exit a trade, nor do they know how to manage risk effectively. This causes inconsistent performance and confusion, especially during volatile market periods. A trading plan should include your entry/exit strategy, risk-per-trade limit, profit target, and how to adapt to different market scenarios. Without this blueprint, it’s easy to get lost and make random decisions. Creating and sticking to a plan can turn your trading from reactive to strategic—and help you survive in a tough market.

Ignoring Emotional Discipline

Trading is more psychological than most people realize. When losses mount or trades go against expectations, fear and frustration kick in. This often leads to revenge trading or abandoning your plan. For beginners, learning how to manage these emotions is just as important as learning technical analysis. Staying calm under pressure, accepting losses gracefully, and not chasing unrealistic profits are all part of emotional discipline. In the Indonesian trading community, many newcomers struggle with this aspect and give up after facing emotional burnout. You must train your mind as much as you train your chart-reading skills.

No Concept of Risk Management

Source: AVA Trade

Perhaps the most dangerous mistake is ignoring risk management altogether. Some traders place all their funds into a single position or trade without stop-losses, believing they can manually monitor everything. But this exposes their account to huge, unnecessary risk. Risk management involves setting strict limits on how much you’re willing to lose per trade—usually no more than 1-2% of your total capital—and applying it consistently. This principle helps you stay in the game even if you experience a series of losing trades. Whether you’re trading crypto or forex in Indonesia, implementing sound risk control can be the difference between lasting success and quick failure.

Overconfidence and Revenge Trading

Source: Quantified Stratergies

Beginners who experience early success often fall into the trap of overconfidence. They increase their position sizes, ignore their strategy, or take more trades than usual, believing they’ve figured it all out. But markets are unpredictable, and what worked once might not work again. When losses happen, overconfident traders often double down to “win it back”—this is known as revenge trading. It’s a dangerous cycle that usually ends in even bigger losses. Trading with humility, staying consistent, and knowing when to walk away are traits that protect traders from this emotional rollercoaster. In the Indonesian scene, overtrading is one of the top reasons new traders wipe out their accounts.

Misunderstanding Market Conditions

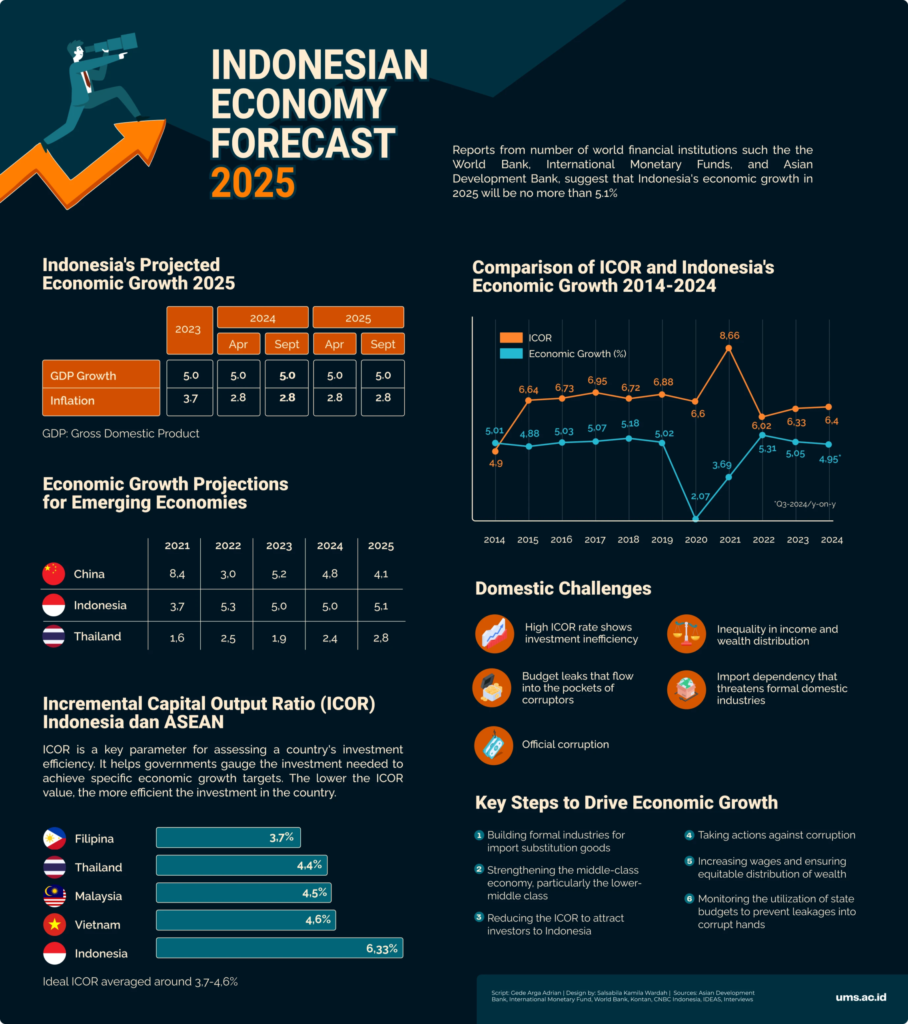

Source: UMS

Markets can trend, range, or act chaotically depending on economic events or liquidity. Many new traders fail to recognize these differences and use the same strategy regardless of conditions. For instance, applying a breakout strategy in a sideways market can lead to repeated losses. Understanding how different environments affect your strategy is crucial. This requires studying price action, volume, and news impact. Beginners in Indonesia often skip this deeper level of analysis, relying solely on indicators or social media signals. But being able to read the market context gives you a serious edge in avoiding unnecessary trades.

Trading Mistakes Beginners Indonesia: Lack of Continuous Learning

Some traders believe that once they know the basics, they don’t need to keep studying. In reality, trading is a lifelong learning process. Markets evolve, new tools emerge, and strategies must be adapted. Successful traders invest time in reading books, analyzing their past trades, and staying updated with economic events. Whether it’s attending webinars, joining a local Indonesian trading group, or following credible YouTube educators, consistent education is key. The more you learn, the better you’ll become at adapting your strategy and avoiding outdated habits that can cost you money.

Trading Mistakes Beginners Indonesia: Falling for Crypto Hype Without Research

Source: Forbes

With the rise of cryptocurrencies, many Indonesian traders jump into the crypto market without understanding the technology or the risks involved. They often buy coins based on hype, FOMO, or influencer recommendations without checking the fundamentals. This can lead to painful losses, especially when the price crashes or the project turns out to be a scam. Before investing in any crypto asset, it’s important to research its use case, development team, and long-term viability. Learning about security, wallets, and how to avoid phishing attacks is also vital. Treat crypto with the same seriousness you’d give to forex or stocks—because it’s equally risky, if not more.

Conclusion: Trading Mistakes Beginners Indonesia- Learn the Lessons Before the Market Teaches You

Every trader starts somewhere, and mistakes are part of the journey. However, many of the most damaging errors can be avoided with preparation, patience, and a commitment to learning. By understanding the most common trading mistakes beginners Indonesia often make, you can save yourself both time and money. Whether you’re just starting with a small forex account or exploring the crypto world, your focus should be on building good habits, managing risk, and avoiding emotional decisions. Success in trading isn’t about making quick money—it’s about surviving long enough to improve and evolve.