Trading psychology Indonesia: In the world of financial markets, technical knowledge and strategy alone are no longer enough. Traders in Indonesia are quickly realizing that the mental aspect—often referred to as trading psychology—is what truly determines long-term success. Trading psychology refers to the mental and emotional state of a trader and how it influences decision-making in the market. It includes understanding your own behavior, controlling impulses, handling stress, and managing reactions to wins and losses. Indonesian beginner traders are especially vulnerable to emotional traps because they are still forming habits and mindset patterns. Without awareness, even a good strategy can collapse under pressure. Developing mental resilience and staying emotionally neutral during trades will put a beginner leagues ahead of others who rely purely on instinct or emotion.

Emotional Discipline: Why It Matters More Than You Think

One of the most important qualities any trader can develop is emotional discipline. This refers to the ability to stick to your trading plan and follow your system even when emotions try to take over. Emotional discipline becomes most critical during high-stress scenarios, such as experiencing a losing streak, watching a missed opportunity, or entering a volatile market. For example, fear might lead you to exit a trade too early, cutting potential profits. On the other hand, greed may cause you to hold onto a position too long, ignoring exit signals in hopes of “just a bit more.” Emotional discipline means you train yourself to act on logic, not on emotional impulses. In the Indonesian trading scene, where news-driven sentiment and rapid price swings are common, having this emotional armor allows you to remain calm and rational even when others panic.

The Danger of FOMO and Impulsive Trading

Source: Forex Training Group

FOMO—Fear of Missing Out—is one of the most common emotional traps for new traders, especially in fast-moving markets like forex, crypto, or volatile stocks. In Indonesia, social media plays a huge role in amplifying FOMO. Seeing traders flaunt big profits on Instagram or hearing about a coin that “pumped 200% overnight” can lure you into trades without analysis or planning. This impulsiveness might feel exciting in the moment, but it usually leads to poor entries, chasing the market, and eventually, preventable losses. Successful traders learn to ignore the noise and stick to their setups. FOMO fades when you trust that more opportunities will come—because they always do. The key is to trade when your system says it’s time, not when emotions try to convince you otherwise. For Indonesian traders trying to stay consistent, resisting FOMO is an essential part of mastering trading psychology.

Learning to Accept Losses Without Emotion

Source: Reddit

Losses are inevitable in trading. Even the most successful traders in the world take losses regularly. What separates professionals from beginners is not how often they win, but how they handle losing. Accepting losses as a natural part of the trading journey is one of the most difficult—but most powerful—skills to develop. It prevents emotional spirals that lead to revenge trading, increased risk-taking, and frustration-based decisions. For traders in Indonesia, especially those trading with smaller capital, every loss can feel more personal or more painful. But the truth is, losses don’t define you as a trader—your response to them does. Instead of seeing a losing trade as a failure, reframe it as feedback. Ask yourself what went wrong, what you can improve, and whether the trade aligned with your rules. Emotionally mature traders use their losses as data to refine their process, not as reasons to panic or quit.

Using a Trading Journal to Track Your Mindset

Keeping a trading journal is one of the most effective tools for developing strong trading psychology. While many traders already use journals to log trade entries and exits, the real power lies in recording your thoughts, emotions, and decisions before, during, and after each trade. For Indonesian traders who are still developing consistency, a journal becomes a personal mirror—it reveals patterns in behavior that aren’t visible in a trading chart. Maybe you consistently make bad decisions after three wins in a row, or you hesitate too much after a losing day. These insights are priceless and help you adjust not just your strategy but your psychology as well. Over time, your journal becomes a learning tool that evolves with you. It’s not just about what you did, but why you did it, and how you felt. The more honest and detailed your entries, the faster your growth in both trading and mindset.

Creating a Pre-Trade Checklist

A pre-trade checklist may seem like a simple tactic, but its impact on trading discipline and emotional control is huge. Before every trade, going through a set of defined questions helps you stay focused and ensures that each decision is deliberate—not emotional. A good checklist includes items like: “Does this trade fit my setup?” “Is my risk/reward ratio acceptable?” “Am I trading out of boredom, fear, or excitement?” Answering these questions honestly forces you to slow down and evaluate the trade objectively. For Indonesian traders—especially those trading part-time or in noisy environments—a checklist can be a lifeline that prevents careless mistakes. It creates a mini-routine that puts your brain into ‘decision mode’ instead of ‘reaction mode.’ Over time, this habit builds consistency and strengthens your ability to trade with intention.

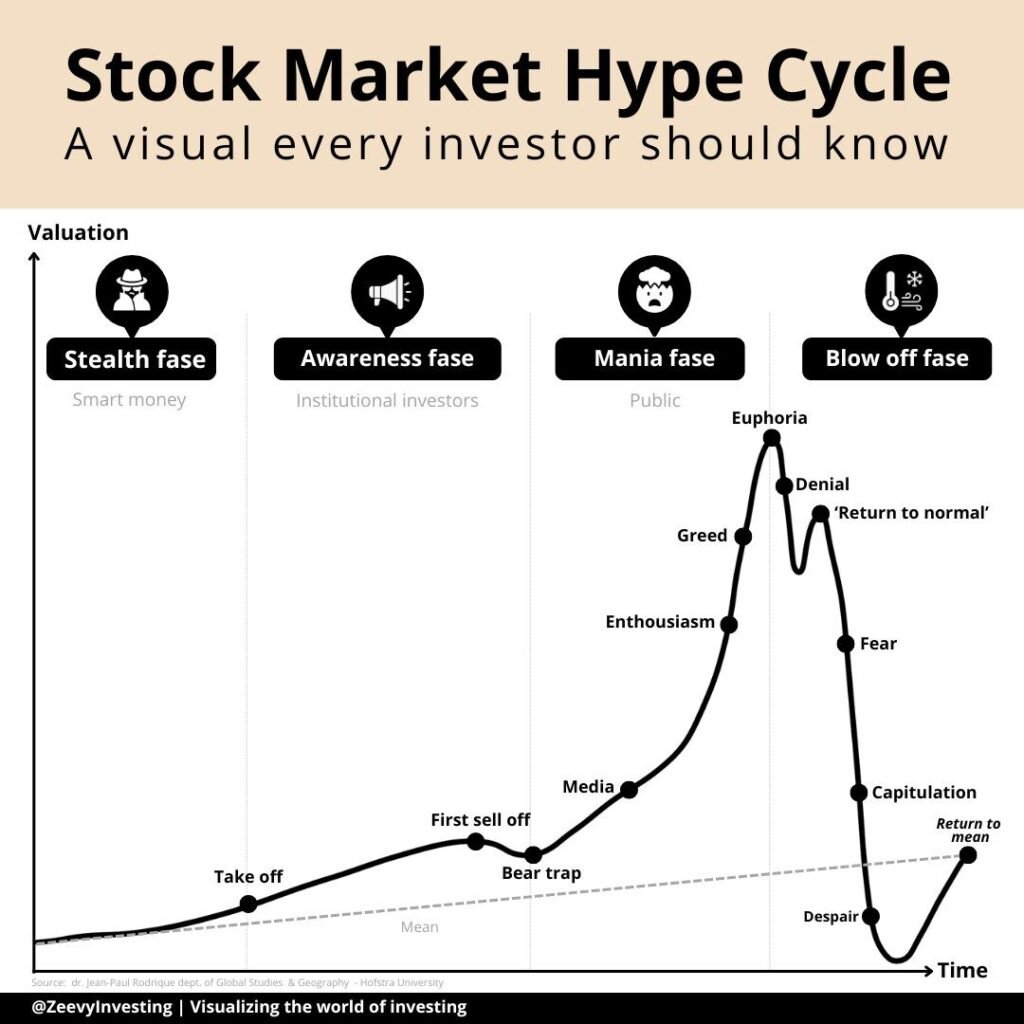

Staying Objective During Market Hype

Source: X

Market hype is a psychological landmine for beginner traders. It creates emotional pressure to act fast, follow the crowd, and make quick decisions based on excitement rather than analysis. In Indonesia, where news spreads quickly via social media, WhatsApp groups, and Telegram channels, it’s easy to get pulled into the excitement of a “hot tip” or viral opportunity. But here’s the truth: the hype rarely leads to good timing. Most people hear about a “breakout” after it has already happened. Staying objective means evaluating every opportunity with your strategy—not your emotions. Ask yourself: Does this setup align with my rules? Have I done my own analysis? Does the risk make sense? Learning to filter out noise and focus only on data-backed trades gives you a powerful edge over impulsive traders.

Practicing Patience: The Quiet Skill of Successful Traders

Source: OPO

Patience is often underrated, but it is one of the strongest psychological traits a trader can have. In reality, great trades don’t appear every hour or even every day. There are periods where the market doesn’t offer anything that fits your plan—and that’s okay. Practicing patience means having the mental strength to wait. It’s about understanding that trading is not a race, but a game of precision. Indonesian traders who chase action or feel pressured to always “do something” often fall into overtrading, which leads to unnecessary losses and stress. Patience also means knowing when to exit, not just when to enter. It’s the quiet confidence to hold your position when the data supports it, and to sit out when the market is unclear. Developing patience early in your trading career sets the stage for long-term discipline and healthier risk-taking.

Trading psychology Indonesia: Recovery Techniques After Emotional Losses

After a tough loss or a bad trading day, your brain can enter a state of overdrive—racing thoughts, regret, and a strong urge to “win it back.” This is when your psychology is most vulnerable. It’s important to have a recovery routine that brings you back to emotional balance. That might include stepping away from the charts, doing light exercise, writing in your journal, or meditating for a few minutes. Avoid making your next trade while still feeling emotional. Many Indonesian traders find that taking even a short break—20 to 30 minutes—can prevent emotionally driven revenge trades. Remember, your mental capital is just as important as your financial capital. Protecting your mindset means giving yourself space to reset and reflect without pressure.

Trading psychology Indonesia: Revisiting the Mind-Method-Money Triangle

The “Mind-Method-Money” model is a simple yet powerful way to understand trading success. The Mind represents your psychology—how disciplined, calm, and self-aware you are. The Method refers to your trading strategy, the setup you follow, and the logic behind your trades. The Money stands for risk management and capital control—how much you risk per trade, where you place your stops, and how you size your positions. If any one of these areas is weak, it affects the others. For instance, a good method and money strategy won’t help if your mind is impulsive and emotional. Likewise, a strong mindset and capital plan can be undermined by a poor or inconsistent method. Indonesian traders should regularly review all three pillars to ensure their trading foundation stays balanced and strong.

Trading psychology Indonesia: Final Thoughts on Trading Psychology Indonesia

Trading psychology Indonesia is more than just a buzzword—it’s the core of consistent, long-term trading success. While strategies and tools can be learned quickly, developing the right mindset takes time, reflection, and emotional maturity. For beginner traders in Indonesia, mastering trading psychology means learning to control emotional responses, build discipline through routines, and constantly refine mental habits. It means treating trading like a skill-based profession, not a gamble or a shortcut to wealth. The good news? Every trader, regardless of their background or capital, can improve their mindset. And as your trading psychology grows stronger, so does your ability to navigate the markets with confidence, clarity, and control.