Whether you’re new to digital assets or a seasoned trader, one concept that deserves your full attention is crypto platform fees. These costs influence how much of your profit you actually keep. By learning how they work, you’ll be better equipped to trade wisely—and avoid unnecessary losses.

What Are Crypto Platform Fees?

To begin with, it’s important to define what we mean by crypto platform fees. These are charges imposed by exchanges for facilitating your trades, deposits, or withdrawals.

There are typically three main types of fees: trading fees (based on the transaction size), withdrawal fees (charged when moving funds out of the platform), and less obvious costs like spread markups or inactivity fees. These costs vary widely between exchanges, and not all of them are transparently listed.

For example, if you trade $1,000 at a 0.2% fee, you’ll pay $2. Some exchanges offer reduced fees for high-volume traders or tiered pricing based on your activity.

How Are Trading Fees Calculated?

One of the most common crypto platform fees is the trading fee. This is usually a percentage of the value of each transaction you make. Exchanges may apply different rates depending on whether you’re a market taker or maker.

Many exchanges use a tiered or maker-taker pricing model to encourage liquidity. For example, makers—those who place limit orders that add liquidity—often receive lower fees than takers, who execute market orders. Binance and Kraken are examples of platforms offering reduced fees for high-volume or token-holding users.

Understanding Withdrawal Fees

Another critical part of crypto platform fees is withdrawal charges. These are the costs associated with moving your funds out of the platform, either to another exchange or a personal wallet.

Withdrawal fees can be fixed or vary based on network conditions, especially on blockchains like Ethereum where congestion can raise gas costs dramatically. Some platforms absorb part of the fee, while others pass it fully onto the user. Always review the withdrawal fee schedule before transferring large sums.

Hidden Fees: What You Don’t See Can Still Cost You

Not all costs are labeled as “fees.” Some platforms embed charges in the spread—the difference between the buying and selling price of a crypto asset.

A platform advertising ‘zero fees’ may still charge you through a widened spread, particularly in platforms that cater to beginners or those using fiat-to-crypto conversions. These spreads may seem minor, but they can add up significantly over time.

For example, a $200 spread between buying and selling Bitcoin can increase your overall expenses over time.

Why Fee Transparency Matters

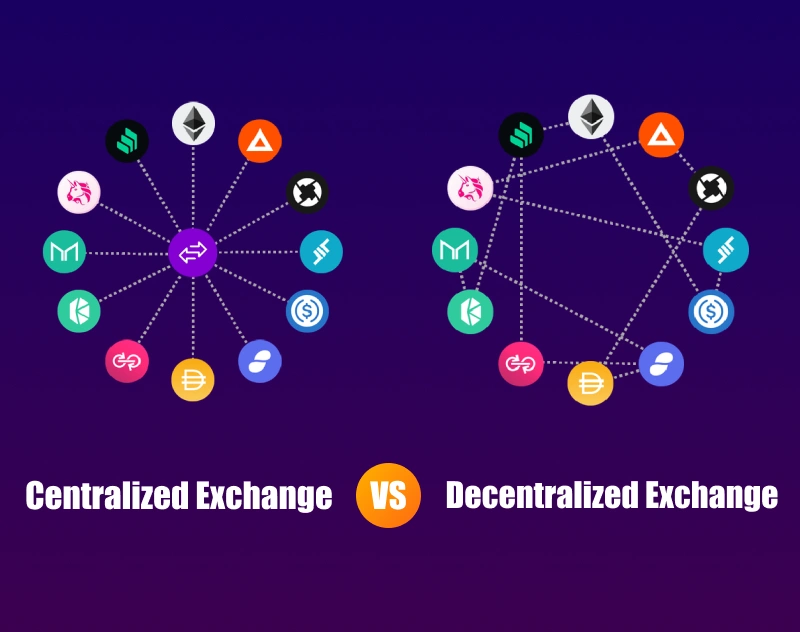

Different platforms operate under different business models. Some aim to provide low-cost trading with minimal markups, while others bundle in additional services and reflect those costs in their pricing.

Being aware of how a platform earns its revenue helps you make informed choices. For example, centralized exchanges may charge higher fees but offer better liquidity and customer support. Decentralized exchanges might be cheaper but less beginner-friendly. Understanding the trade-off helps you select the best fit for your goals.

Final Thoughts on Crypto Platform Fees

Knowledge is your best tool in managing crypto platform fees. Don’t just focus on trading costs—look at the entire fee structure, including withdrawals, spreads, and less obvious charges. A few percentage points saved on each transaction could translate to hundreds or even thousands over time.

The more you understand the fee system, the more control you have over your crypto journey.

Relevant news: here